Social and Environmental Capital

Resilience

The ability of a system to prepare for threats, absorb impacts, recover and adapt following persistent stress or a disruptive event.

Resilience is now on the mainstream sustainability agenda, in looking to build systems and capabilities to face challenges that business and society will have to face in this “exponential decade”. DFCC Bank is looking to build internal systems that are resilient in the face of significant changes in the economy and regulatory landscape, as well as add value to its customers by offering services that make them more resilient. Furthermore, the Bank is taking care of its own footprint as well as those in its portfolio to contribute towards greater resilience in its operations, those of its customers, and all its stakeholders, contributing towards a more resilient Sri Lanka.

DFCC Bank’s Sustainability Policy

The case for social and environmental sustainability as a winning business strategy has been gathering strength over the years, as available empirical evidence continues to confirm the numerous benefits that accrue to all stakeholders, as well as the environment and society. More importantly, businesses worldwide have begun to incorporate social and environmental sustainability into their business plans.

The Bank's sustainability activities will actively contribute towards specific Sustainable Development Goals (SDGs), as spelled out by the United Nations.

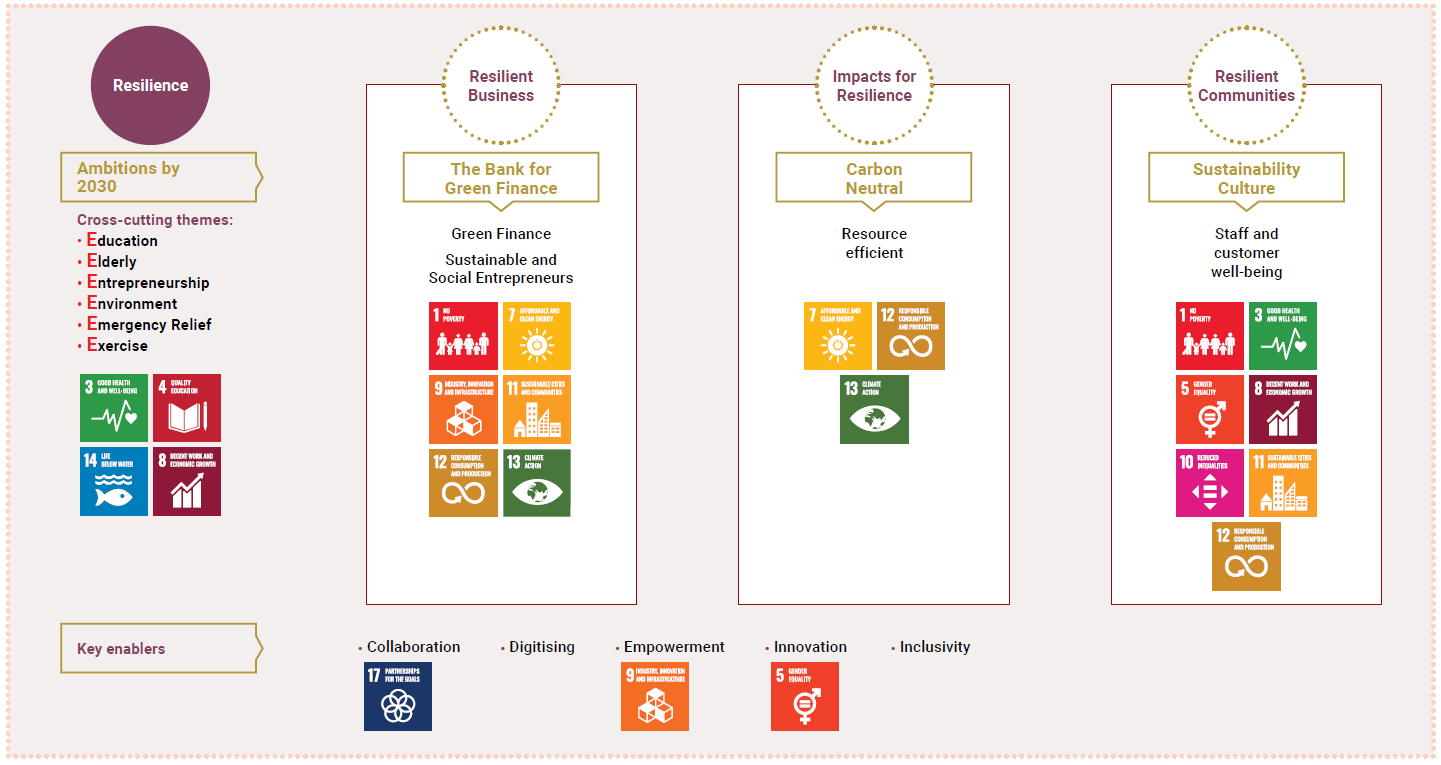

The overall vision of a sustainable DFCC Bank and its goals is conceptualised as follows:

DFCC Sustainability Strategy 2020-2030

Strengthening internal capabilities to implement the Sustainability Strategy

In 2021, the Bank strengthened its internal capabilities to implement the Sustainability Policy, Strategy and Plan developed in 2020 for the period 2020 to 2030. These include the following:

- Capacity building of staff on Sustainability aspects, including the certification course on the six Electronic-Learning modules of the Sustainable Banking Initiative (SBI) of the Sri Lanka Banks’ Association (SLBA). A total of 112 staff members, in addition to the CEO have completed this course by 31 December 2021

- Increasing staff awareness on Sustainability via newsletters, sustainability quizzes, EDMs, attending relevant online and in-person conferences and training programmes etc.

- Formation of a Sustainability Champions Network of 166 Champions, with staff members representing each of the branches/departments

- Appointment of 12 staff as “6E Champions” to develop the six thematic areas

- Formation of several sustainability task forces and subcommittees to develop identified areas required for implementation of the Sustainability Strategy. Accordingly, the following five task forces were set-up under Wave 1 in January 2021 for a period of six months:

- Energy

- Resource Efficiency

- Green Finance

- Sustainable and Social Entrepreneurship

- Creation of a Sustainability Trust/Foundation

In July, under Wave 2, four of the above task forces were made into permanent subcommittees, relating to the Bank’s sustainability targets and one Task Force was discontinued after achieving its purpose. In addition, three more task forces were also set-up under Wave 2. Accordingly, the following teams were active from July 2021:

- Energy Subcommittee

- Paper Subcommittee

- Green Finance Subcommittee

- Sustainable and Social Entrepreneurship Subcommittee

- HR Sustainability Task Force

- Sustainable Events and Promotions Task Force

- Sustainable Procurement Task Force

- The cross functional Executive Sustainability Management Committee (ESMC) set-up in 2020, ensured the proper implementation of the sustainability strategy, in addition to making strategic decisions on the implementation process and the initiatives. ESMC is headed by the CEO and consists of 19 staff, including several C-level staff. ESMC meetings were held once in every six weeks.

- Working with the HR Department to develop incentives to promote and acknowledge staff participation in sustainability initiatives.

- Setting up of the “DFCC Sustainability Trust”, a separate entity to carry on the Sustainability/CSR initiatives of the Bank, so as to provide more transparency and accountability. The trustees comprise the Chairman, two Directors, the CEO and three Senior Management staff.

- Conducting two sessions on “Gender Sensitisation” for Senior Management

Signatories/Membership of Sustainability Initiatives/Networks

Sustainable Banking Initiative

DFCC Bank is a pioneering signatory to the 11 Sustainable Banking Principles of the Sri Lanka Banks’ Association (SLBA) under the Sustainable Banking Initiative (SBI).

Global Sustainable Finance Network

DFCC Bank is a member of the Global Sustainable Finance Network (GSFN), which is a voluntary membership based global initiative launched in 2011 under the auspices of the World Federation of Development Financing Institutions (WFDFI) by the European Organisation for Sustainable Development (EOSD) and the Association of Development Financing Institutions in Asia and the Pacific (ADFIAP).

The vision of GSFN is a thriving, pre-eminent global community of financial institutions and other stakeholders working together for projects, programmes and activities that are socially beneficial, environmentally responsible and economically viable.

Social and Environmental Management System (SEMS)

The Bank’s Sustainability Unit is tasked with implementing the Social and Environmental Management System (SEMS) of the Bank, which ensures that projects funded by the Bank adhere to the required environmental and social regulations, while also encouraging clients to be more social and environment friendly.

The following practises which were implemented by the Sustainability Unit in 2020 were continued during the year for all term loans over LKR 25 Mn:

- Conducting an Environmental and Social (E&S) risk assessment during the appraisal stage to arrive at an E&S risk categorisation and providing comments on E&S aspects. This assists loan approving authorities as a decision tool on the level of E&S risks/impacts associated with each loan.

Given below is a summary of this process as at 31 December 2021:

| Number of loans | Percentage of loans | |||

| High Impact (A) | 134 | 33 | ||

| Medium Impact (B) | 14 | 3 | ||

| Low Impact (C) | 40 | 10 | ||

| Very Low Impact (D) | 218 | 54 | ||

| Total | 406 | 100 |

- Monitoring of E&S aspects during the entire tenure of the loan.

- Sustainability Unit also carries out monitoring of E&S aspects of all loan facilities granted under credit lines and loan facilities

- Approvals for the following were obtained and implemented during the year:

- A new Exclusion list

- A Child and Forced Labour Policy

Sustainability Initiatives

The Bank continued to implement many sustainability initiatives during the year under review.

Education: “Samata English” – English Educational programme for youth

“Samata English” is a programme aimed at enhancing the English competency of youth aged 18-22, grooming them to confidently enter the workforce. This was started in 2017 as a pilot in Gampaha and Kalutara and was extended to Kandy, Kurunegala, and Galle in 2018 and Polonnaruwa, Ampara, Jaffna, and Ratnapura in 2019, benefiting over 400 youth in these areas. Due to the COVID-19 pandemic, the Bank conducted this as an online programme in 2021 for 100 youth in Anuradhapura, Vavuniya, and Badulla Districts. Training of soft-skills, including leadership ability, time management, presentation and writing, and how to face an interview were also added to the 2021 programme, as these skills are invaluable in today’s job market and also ensure that youth excel in their careers. Students were also provided with a data allowance and hands-free sets to motivate them to attend the online sessions. DFCC Bank has partnered with Gateway Language Centre to conduct the educational sessions of Samata English on behalf of the Bank. Upon successful completion of this 4-month online programme, the top achievers across the regions will be offered the opportunity to join the Bank as interns, creating opportunities for them to apply what they have learnt, gain work experience and develop their skills.

Education: Caritas Sri Lanka – SEDEC Scholarship programme

The Bank continued with the scholarship programme which was commenced in 2020 by teaming up with Caritas Sri Lanka-SEDEC by providing financial assistance to youth of vulnerable low-income families to continue their education without interruption and build their own path to higher education or entrepreneurship. This scholarship programme will be for a duration of five years and have a minimum of 100 recipients at a given time.

Education: Assistance to Lankadhara Society

The Bank assisted the Lankadhara Society, a transit home in Colombo 6 with nearly 50 underprivileged girls between the ages of 5 and 18 for their educational needs. These include donation of two laptops in January 2021 to enable the students to continue their studies through online learning, and conducting an online English course through Gateway Language Centre to 18 O/L and A/L students from July 2021 under the Scholarship scheme with Caritas Sri Lanka.

Education and Emergency Relief: Assisting the education of victims of Easter Attack

Staying true to its commitment towards helping during emergencies, the Bank has made donations to 12 children affected by the Easter attack in 2019. This will be continued as grants until they complete their school education.

“Digital Dansala” was a programme that enabled customers and staff to donate cash to assist local communities affected by COVID-19

Environment and Resource Efficiency: Reducing resource consumption

The two task forces on Energy and Resource Efficiency that was set-up in 2020 to assess baseline consumption of several resources, including paper, electricity, water, etc. were made into two permanent subcommittees for Energy Efficiency and Paper in July 2021. Both subcommittees have made significant contributions with regard to monitoring and reduction of consumption.

Emergency Relief: Providing emergency relief to people affected by COVID lockdowns

The Bank conducted a “Digital Dansala” in May and June 2021 powered by DFCC Virtual Wallet to raise funds to provide dry rations to local communities affected by the COVID-19 pandemic. Through “Digital Dansala”, customers and staff were able to make cash donations of any value towards this initiative from the DFCC Virtual Wallet and the Bank matching the amount collected. The distribution of dry rations to the communities in all parts of the country were coordinated by the nine Regional Offices through the assistance of the branches. Special emphasis was given to the selection of the recipients, so as to ensure that the most deserving people were provided with this assistance. More than 550 relief packs were distributed through this initiative.

Resilient Communities – HAND Washing Booths in Rural Schools

The Bank donated and installed hand-washing booths in selected rural schools across the country, in keeping with hygienic practices required to control the spread of COVID-19. DFCC Bank received support from the Ministry of Education, and carried out considerable level of ground-level research in order to select the schools which were the most in need of such support.

“Samata English” was conducted virtually to develop soft skills of youth to help them advance their careers

Entrepreneurship: Supporting Women Entrepreneurs

Female participation in the workforce in general, and entrepreneurship in particular, is relatively low in Sri Lanka due to sociocultural factors, which has prevented the economy from reaching its full potential. Addressing this important issue, the Bank launched “DFCC Aloka”, an exclusive women's proposition that will enable female entrepreneurs and professionals to fully benefit from financial services and financial inclusion, in addition to promoting female entrepreneurship development. This proposition is being actively pursued, with the participation of the branch network across the island supporting all income levels of females towards empowering.

We also support educational loans, housing loans and SME and MSME loans with special pricing, including non-financial services such as career development programmes, which will enable “Aloka” customers to fulfil their dreams and reach greater heights and be successful in their career or business.

Resilient Business: Supporting SMEs and MSMEs

As a number of SMEs and MSMEs were financially affected by the COVID-19 pandemic, the Bank provided a reprieve by way of moratoriums, in line with the CBSL guidelines. The “DFCC Sahanaya” was one such concessionary loan scheme that helped to sustain and revive the sector.

This loan scheme was specifically intended to finance innovative projects, employment generating projects, export-oriented projects, livestock and agricultural projects, and other development projects that could help reinvigorate the economy.

In 2021 the Bank initiated “Krushibala”, a loan scheme exclusively to assist the individuals and business entities in the SME sector engaged in Agriculture at a concessionary rate of interest to overcome the difficulties they faced during the pandemic and to rebound their activities, and as a support for Government initiatives on the Agriculture sector.

As an institution which has its roots in development banking, DFCC will continue to support and provide financial and advisory support to SMEs across a variety of sectors, including agriculture, export, manufacturing, health, education, construction, and others in the years ahead.

RESILIENT BUSINESS: THE BANK FOR GREEN FINANCE

As a part of the goal of becoming “The Bank for Green Finance” under its sustainability strategy 2020-2030, DFCC will continue to focus on promoting projects that make products or develop technologies that are primarily aimed at reducing greenhouse gas emissions or supporting the use of renewable energy.

Environment and Exercise: Cycling

Riding bicycles to school or work is an integral aspect of provincial life in Sri Lanka, keeping the population in these areas healthy and relatively disease-free, which is not the case in urban areas, especially Colombo. The Bank has recognised the need to promote cycling for health and fitness, as part of its new Sustainability Strategy. The Pinnacle Centre in Colombo – 7 has been designed to accommodate customers who are cycling enthusiasts, and is equipped with changing rooms and shower facilities.

DFCC Bank’s Wellness Committee (OMMM) commenced a “Bike to Work” initiative, with a day in each month devoted for staff members to ride bicycles to work. This is another bank-wide initiative to encourage employees to maintain a sustainable and healthy lifestyle. DFCC Bank has also made a commitment to give cycling a high priority by encouraging staff to take on cycling as a hobby, so as to make it a lifestyle choice.

Exercise: Initiatives by the DFCC Bank’s Wellness Committee – OMMM

“Achieving Sustainable Work-Lifestyles by 2030” is one of the Big Goals that DFCC Bank has identified in its Sustainability Strategy for 2020-2030. The Bank seeks to advance sustainable workplaces and lifestyles via governance, including sustainable workplace practices, as well as lifestyles for clients and staff in general. This includes a range of elements from promoting diversity and inclusivity, to productivity-oriented wellness and sustainable consumption and lifestyle practices.

DFCC Bank’s Sustainable Future

The Bank’s commitment to sustainability is integrated into its business planning and operations by establishing and maintaining a transparent, time-sequenced Sustainability Strategy and Plan. The Plan includes detailing of its goals and tracking the relevant metrics, to ensure its success. The Bank, during last year, has been developing its systems, to embed sustainability into its business practices.

The Bank lives up to the change it wishes to see by raising its employees’ awareness of sustainability and responsible behaviour through relevant training on sustainability. This is intended to motivate them to play a pivotal role in implementing the Bank’s Sustainability Policy and Strategy.

DFCC Bank is steadfast in its commitment to comply and encourage its clients, to adhere to all applicable environmental and social laws, rules, and regulations of Sri Lanka, as well as with international best practices.

The Bank, aims to be a bank for Sustainable and Green Finance, in drawing on its history of financing landmark renewable energy initiatives in Sri Lanka. It also looks to develop sustainable and social entrepreneurs who seek to develop solutions to the challenges affecting the society. In doing so, the Bank contributes towards strengthening the resilience of Sri Lanka.

Recognition for Sustainability in 2021

Global Sustainable Finance AWARDS 2021 – City of Karlsruhe, Germany

- Merit Award – Outstanding Business Sustainability Achievement for incorporating sustainability in its corporate strategy and its business processes

- Merit Award – Sustainability Leader of the Year for Mr Lakshman Silva, former CEO, DFCC Bank PLC to recognise his exceptional leadership in driving the business performance of the Bank through creating social, economic, and environmental values

Association of Development Financing Institutions in Asia and the Pacific (ADFIAP) Awards 2021

- Merit Award – Outstanding Development Project Award for Financial Inclusion for its MSME project, “Supplier Financing Scheme for Export Agricultural Crops”.