Customer Capital

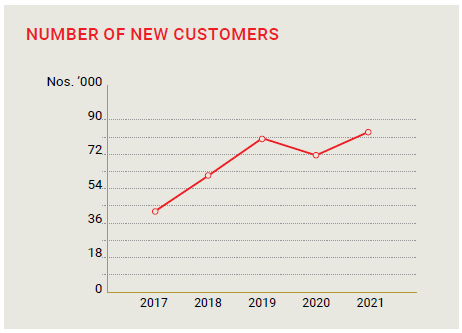

Customer-centricity is a concept that is deeply embedded within the Bank’s ethos. With a heritage spanning over 66 years, the Bank has constantly engaged with customers on a personal basis, resulting in enduring relationships across a broad range of segments. As the number of accounts surpasses over half a million, DFCC Bank continues to guide customers in helping them make the most prudent and positively impactful financial decisions that help them reach their goals in life.

Customer-centricity assumes greater significance, given the Bank’s stated goal of reaching two million customers. It is one of the key pillars defined in the Vision 2025 strategy plan. Building and enhancing the customer experience, along with adding value to the relationship, is a crucial component of the Bank’s approach to customer-orientation. DFCC Bank continues to harness the benefits of innovative product and service offerings to customers, ensuring mutually-beneficial, long-term relationships.

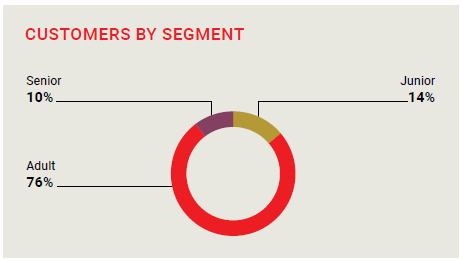

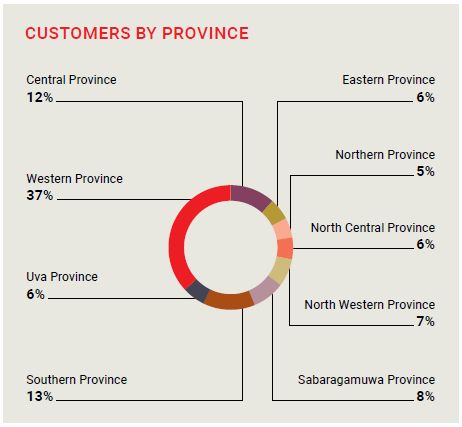

Customer profile

Product portfolio

SAVINGS ACCOUNTS

DFCC Winner – Among the best interest rates for accounts with a minimum balance of LKR 2,500/-. This account is also for businesses and for individuals who are over the age of 18 years.

DFCC Mega Bonus – Interest rates on offer increases along with account balance on savings deposits, for businesses and individuals aged 18 years and above.

DFCC Xtreme Money Market Account – Offers one of the highest interest rates for Rupee and Dollar denominated savings, based on the account balance for businesses and individuals aged 18 years and above.

DFCC Garusaru – Offers attractive interest rates, reward schemes and a range of other benefits for senior citizens who are above 60 years of age.

DFCC Junior – Children’s savings account which offers an exciting range of gifts and preferential interest rate for children below 18 years of age.

DFCC Junior Plus – Children’s savings account with a higher interest rate for children below 18 years of age.

DFCC Teen – Savings account with exclusive offers, benefits and higher interest rate for teenagers who are between 13 and 18 years of age.

SPECIAL DEPOSIT ACCOUNT

Offers highly attractive returns for funds received from abroad via inward remittances. Fixed deposits can be placed under this account in any designated foreign currencies or Sri Lankan Rupees. This is an ideal account for Sri Lankans who are employed overseas.

PRODUCT PROPOSITIONS

These have been separated into varying categories, catering to different segments, distinct needs, wants, aspirations and lifestyle to offer the most suitable financial solutions. These include savings accounts, current accounts, debit and credit cards, as well as personal loans.

DFCC Salary Plus

DFCC Salary Partner

DFCC Prestige

DFCC PinnacleDFCC Aloka Women’s Proposition

HOUSING LOANS

DFCC Home Loans – Flexible and convenient housing loans at competitive interest rates for self-employed individuals, professionals, and salaried individuals. These loans can be used for purchasing or constructing a house or apartment, as well purchasing a plot of land, renovating a house, etc.

PERSONAL LOANS

A wide range of personal loans catering to the varying needs of different categories of salaried employees and professionals in the private and Government sectors.

DFCC Education Loans – Flexible and convenient loan facilities to fund the higher education of individuals pursuing higher studies in Sri Lanka or overseas.

DFCC Garusaru Personal Loans – Special personal loan scheme for Government pensioners.

LEASING FACILITIES

DFCC Leasing for brand new and unregistered/registered vehicles, machinery, plant and equipment for corporates, SMEs, entrepreneurs, professionals and individuals.

DFCC CREDIT CARDS

The only Credit Card that offers 1% cashback on every personal card transaction, 365 days of the year.

BANCASSURANCE

Insurance and assurance solutions for corporates, SMEs, entrepreneurs, professionals, and individuals.

PAWNING SERVICES

Financing immediate cash requirements of individuals.

DIGITAL PRODUCTS AND SERVICES

DFCC Virtual Wallet (Hybrid mobile banking app)

DFCC iConnect

DFCC Pay App

DFCC Chatz/DFCC Video Chatz

MTeller

eStatements

DFCC Alerts (SMS)

DFCC Online Banking and Mobile Banking

DFCC MySpace (Digital Channels – ATMs, CRMs, CHDMS, Pay&Go Machines)

NF2F – Virtual customer on-boarding (Non-Face to Face)

DFCC Bank Website

The website continues to support key banking functionalities, in addition to customer relations and communication efforts. The Bank is focused on improving the interactive features of the website, In addition to traditional website functions such as customer interactions and communications, the Bank’s website continues to support critical banking operations that improve client convenience and assist internal banking processes. All DFCC Bank branch locations were listed and optimised on Google to support local searches resulting approximately 200,000 actions (website, calls, directions) via the local listing. For the year 2021, the Bank’s website had 1.3 million sessions and continues to support business to acquire customers digitally.

New features introduced in 2021

- Non-Face To Face (NF2F) implementation of Digital on-boarding and Account Opening Process, converting the website to a semi-digital branch, enhancing customer convenience and matching the new normal. Further, this feature enables customers to open accounts in the comfort of their homes or office. The initiative also supports one of the Bank’s sustainability strategies of moving towards a paperless and eco-friendly environment.

- The online credit card application was upgraded in sync with the Bank’s processes.

- Dynamic Pinnacle page with relationship manager details was developed.

- Website Speed Optimisation for an improved user experience and compliance to Google core web vitals.

- Credit Card comparison upgrades with new products (Mastercard, Affinity Card to compare and choose the most appropriate card type)

- Microsite for DFCC Aloka Product Page was developed to empower Sri Lankan women with exciting offerings.

- Dynamic page for Virtual Wallet with wallet merchant information.

DFCC Chatz

The interactive, multi-channel chatbot continues to provide assistance to customers through the corporate website, Facebook Messenger, and Viber. Customers can interact with the conversational DFCC chatbot in a language of their choice. For complex inquiries which can’t be handled by the chatbot, customers will be directed to a live chat with a Contact Centre agent available 24/7. The bot was revamped and a new flow based chat and search feature was introduced while the option to chat with contact centre agent was embedded to the main chat window. 36,659 chat sessions were conducted during the year, an increase of 135% over the previous year. New channels and capabilities will be integrated to DFCC Chatz in the year 2022.

CREDIT LINE/SUBSIDY SCHEME SUPPORTED PROJECT LOANS

- “Saubagya” (Prosperity) Loan Scheme for Small and Medium Enterprises (SMEs).

- Small and Micro Industries Leader and Entrepreneur Promotion Project III Revolving Fund (SMILE III RF)for SMEs.

- Small and Medium-Sized Enterprises Line of Credit – (SMELoC) for SMEs.

- Emergency Response Facility – Working capital loan scheme for SMEs.

- Tea Smallholder Credit Line – For tea smallholders to carry out leaf production.

- Environmentally Friendly Solutions Fund II – Revolving Fund (eFriends II RF) for pollution reduction and efficiency improvement initiatives.

- Smallholder Agribusiness Partnership Programme (SAPP) for out-grower farmers and youth entrepreneurs connected to the agriculture value chain.

- Rooftop Solar Power Generation Line of Credit (RSPGLoC) for rooftop solar power systems of up to 50 kW.

- New Comprehensive Rural Credit Scheme (NCRCS) for short-term cultivation.

OTHER PROJECT LOANS

Term loans for corporates, SMEs, professionals and individuals.

WORKING CAPITAL FINANCING

Short-term working capital financing – overdrafts, revolving credit or short-term working capital loans for corporates, SMEs, entrepreneurs and current account holders.

Medium, long-term loans to finance permanent working capital requirements for corporates, SMEs and entrepreneurs.

DFCC “SAHAYA”

A one-stop financial solution offering loans, leases, bank guarantees and other commercial facilities for MSMEs.

HIRE PURCHASE FACILITIES

Hire purchase facilities for vehicles for corporates, SMEs, entrepreneurs, professionals, and individuals.

GUARANTEE FACILITIES

Bid bonds, advance payment bonds, performance bonds, bank guarantees for credit purchase of goods for corporates, SMEs, entrepreneurs, professionals, and individuals.

LOAN SYNDICATION

Loans provided by a group of lenders which is structured, arranged and administered by one or several banks, for corporates.

CONSULTANCY AND ADVISORY SERVICES

Provision of legal, tax, finance, market, and other advisory services to start up a new business or revamp existing businesses for corporates, SMEs and entrepreneurs.

Branch Network and Service Delivery

DFCC Pinnacle Centre, located in Colombo 7, provides customised banking services encompassing relationship management, as well as services related to capital markets, wealth management, portfolio management, real estate, legal, and investment. The branches in Welikanda, Kottegoda, Uragasmanhandiya and Homagama were upgraded to provide more banking facilities, while Rambukkana and Hakmana branches were relocated in order to offer increased customer convenience.

Over 5,500 LankaPay ATMs across the island allow customers to access the Bank’s Services. Ranking among the most customer-centric and digitally enabled banks in the country, DFCC is able to reach out to customers with ease and convenience. A 24/7 Contact Centre, along with the corporate website, enables customers to communicate with the Bank in English, Sinhala, or Tamil.

New Products and Services in 2021

Taking pride in being the “Bank for Everyone”, DFCC launched a number of new propositions, taking a more nuanced approach to segmenting retail customers. This was also in alignment with the Bank’s customer-centric approach. Carrying out a strategic analysis of customers’ life journeys, the Bank was able to craft a range of propositions which would fulfil their aspirations and help them reach their financial goals at different stages of their lives.

Customers taking up any of our propositions will receive a complementary branded international debit card with enhanced withdrawal and POS limits. It also entitles them to free access to all DFCC Bank ATMs and over 5,500 LankaPay ATMs, in addition to free digital banking services such as DFCC Virtual Wallet. A lifetime free credit card is offered to eligible candidates, providing cashback on transactions and six months’ interest-free instalment plans. Each proposition also offers special pricing on banking products, tariffs with exclusive fee waivers, rewards and benefits.

Mastercard and Merchant Acquiring Services

The Bank launched Mastercard issuing with the introduction of the World Card and enabled the card acceptance on the Point of Sale (POS) Machines. The World Card was made available for existing and new customers who can apply by requesting for a new card with a stand-alone limit or by splitting their current credit limit as they see fit. The new card is perfect for professionals, entrepreneurs, and businessmen who are looking for new opportunities to enhance their purchasing power.

The merchant services were enhanced by the Mastercard acceptance on the POS machines which assisted with recruiting high volume merchants. A new Android-based POS machine was introduced which accepts all major credit card transactions via tap-to-pay, CHIP reading or swiping the mag-stripe. A partnership was forged with Visa International to recruit Micro Merchants in a bid to encourage SME business to accept payment cards. The objective of the programme is to bring in financial inclusion to the rural economy and to penetrate the card acceptance by offering preferential pricing to this segment.

DFCC Aloka

The DFCC Aloka proposition can be opened with an initial deposit of LKR 1,000/-. It is bundled with a range of special features from higher interest rates of up to 4.25% per annum, several identified lifetime benefits and tailor-made support for businesses. Account holders can also obtain a special debit card with the joining and annual fees waived off, free withdrawals from any DFCC or LankaPay ATM, free digital banking services and access to a home banking service via MTeller. As part of the preferential business support options provided to DFCC Aloka customers, special consultations tailored for setting-up and managing MSME’s and extensive entrepreneurial support will also be on offer along with exclusive loan schemes.

DFCC Aloka customers will also experience further benefits in the form of personal and housing loans at preferential interest rates, special rebates on loan processing fees, access to pawning facilities at preferential interest rates, eligibility for a brand-new credit card with joining and first-year annual fees waived, around the year offers and deals on clothing, supermarket shopping, dining, entertainment, leisure and travel and access to 6-month 0% Easy Payment Plans for credit card transactions above LKR 25,000/-. Customers will also receive free life insurance cover, up to 10 times their average savings balance (up to a maximum of LKR 1 Mn) and receive free digital health solutions via Doc990 for themselves and three family members. To top it off, customers will also be entitled to a range of milestone-related rewards to mark special occasions throughout their time with DFCC Bank, such as childbirth, the 21st birthday of the customer, graduation, weddings and 25th wedding anniversary.

All Sri Lankan women aged 18 years or above can join the DFCC Aloka proposition. The proposition is supported by a “24x7” dedicated hotline to ensure preferential service and customer convenience.

DFCC Mehewara

This special personal loan scheme is designed to cater to the loan requirements of brave heroes of the Sri Lanka Armed Forces. Loans are provided up to LKR 5 Mn with a longer repayment period of 10 years.

DFCC Teachers’ Loan

A special personal loan scheme was launched targeting the teachers in government and private sector schools. Executives and senior executives in education administrative service are also eligible to apply for loans under this scheme. Loans are provided up to LKR 4 Mn under this loan scheme with attractive interest rates.

DFCC Auto Loan

This product was introduced to maximise the boom in registered vehicle market due to the restrictions imposed in vehicle imports. The product gives the borrower a leverage to afford a vehicle with a structured repayment plan including a residual value. The rollover option embedded in the product enables the client to continue the loan for another five years without settling the residual at the end of the loan period. Client gets the option of even settling the residual by disposing the current vehicle and going for a fresh loan for a new vehicle.

Professionals and salaried individuals who are earning a minimum of LKR 100,000/- as fixed salary or engaged in own private practices are eligible to apply for Auto Loans.

DFCC Power Leasing

This special leasing product was introduced with a view to enhance the affordability of a vehicle for an individual or SME. Corporate customers also can use this product for financing vehicle fleets. Product is designed with a residual value and option for a rollover at the end of the lease period.

Structured Housing Loans

This product is designed to match the different cash flow patterns of the clients. Repayment structures are designed with set up plans, grace periods, bullet payments, residual payments etc. The product could be used for outright purchase of a residential bare land, house or apartment as well as construct a residential house on own land or purchase a land and construct a house.

DFCC “KRUSHIBALA”

DFCC Bank has introduced “DFCC Krushibala”, an exclusive concessionary credit line to facilitate the country's agriculture Sector. LKR 3.0 Bn worth of facilities rolled out to the SME sector at the rate of 7% per annum, exclusively to facilitate clients engaged in diverse agricultural related activities such as cultivation, livestock, commercial agriculture, agri export, processing, storage, organic farming and many other agriculture related activities. Considering the critical role played by women in the Sri Lankan agriculture sector, the credit line has given preference to businesses with significant participation of women.

Supporting Customers During the Challenges of COVID-19

In line with CBSL’s relief guidelines as well as its own volition, DFCC Bank continued to provide relief to customers affected by the COVID-19 pandemic. While the Government took steps to protect citizens through extended curfews intended to slow down the spread of infections, it impacted the earnings of people, especially daily wage-earners.

Customer-centricity

Customer-centricity occupies pride of place as one of the three strategic pillars of the Bank’s Vision 2025. Pursuing an unwavering focus on this concept will help the Bank to achieve its long-term objective of acquiring two million customers, and becoming the most customer-centric bank in Sri Lanka. The core banking system is envisaged to play an invaluable role in the Bank’s quest to achieve this objective.

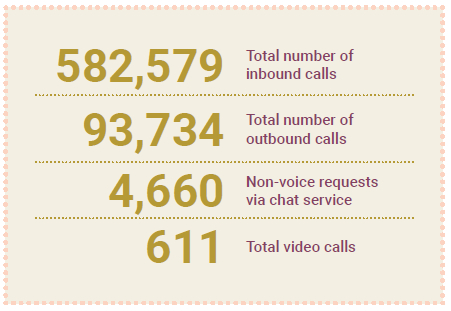

Contact Centre

Creating a customer experience that is prompt, personalised, responsive, and courteous is key to ensuring an enhanced customer-oriented value proposition. The opening of a state-of-the-art Contact Centre in Malabe that can host over 50 customer service agents is one of the steps taken in this direction. Staff at the Contact Centre are well-trained to assist customers with their financial inquiries and activation of products, 24x7, 365 days a year. Dedicated agents have been appointed specifically to cater to the needs of high net-worth segments, who expect a higher level of specialised services.

The Contact Centre continued uninterrupted operations, 24 hours a day, during the pandemic and lockdown periods, working in extended shifts across two locations. Remote working facilities were made available to ensure continuity of service during times when strict compliance with safety protocols was required. The Contact Centre enhanced its service offerings such as; the Video Chat option, to assist customers on-board themselves to digital products. The Live agent chat option which enables customers to obtain instant and tailor made solutions to their inquiries. Virtual on-boarding of Customers to digital services such as the Virtual Wallet, Online Banking continues to encourage customers to fulfil their banking needs from their homes.

In addition The Non-Face To Face (NF2F) digitally enabled account opening facility assist customers with convenience even whilst being overseas.

Existing systems are also being enhanced, along with improving agent skills and product knowledge. Churn management has been added to the agents’ skills-set.

The Contact Centre is a critical service at the Bank, as it functions as the primary point of contact for customers. The Centre is fully geared to operate 24x7, 365 days a year, handling inbound and outbound calls and other functions, playing an invaluable role in the Bank’s operations.

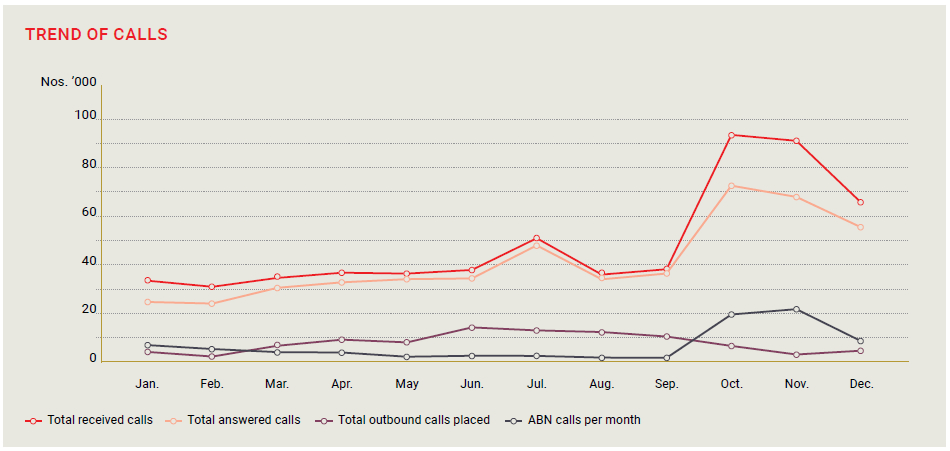

Summary of Inbound and Outbound calls 2021

| Jan. | Feb. | Mar. | Apr. | May | Jun. | Jul. | Aug. | Sep. | Oct. | Nov. | Dec. | ||||||||||||

| Inbound 2021 | |||||||||||||||||||||||

| Total Received calls | 32,980 | 30,446 | 34,149 | 36,315 | 35,949 | 37,502 | 50,772 | 35,527 | 37,809 | 94,012 | 91,497 | 65,621 | |||||||||||

| Total Answered calls | 24,213 | 23,556 | 30,126 | 32,468 | 33,793 | 34,112 | 47,990 | 33,728 | 36,140 | 73,094 | 68,337 | 55,536 | |||||||||||

| Average Answered call per day | 1,063 | 1,087 | 1,101 | 1,210 | 1,160 | 1,250 | 1,638 | 1,147 | 1,260 | 3,033 | 3,050 | 3,120 | |||||||||||

| Average Talk time (MM.SS) | 3.32 | 3.25 | 3.12 | 3.19 | 3.10 | 3.24 | 3.25 | 3.34 | 3.28 | 5.14 | 4.03 | 3.54 | |||||||||||

| Average ACW time (MM.SS) | 11.03 | 9.09 | 10.01 | 10.39 | 11.30 | 15.03 | 18.11 | 11.56 | 11.33 | 21.09 | 22.39 | 22.01 | |||||||||||

| Average Answer time (MM.SS) | 0.51 | 0.60 | 1.10 | 1.10 | 0.47 | 0.53 | 0.47 | 0.33 | 0.51 | 3.19 | 2.12 | 2.23 | |||||||||||

| ABN Summary 2021 | |||||||||||||||||||||||

| ABN Calls per Month | 6,651 | 4,964 | 3,662 | 3,450 | 1,667 | 2,064 | 2,025 | 1,255 | 1,151 | 19,883 | 22,208 | 8,373 | |||||||||||

| ABN Calls placed per Month | 2,397 | 3,640 | 2,189 | 1,354 | 901 | 1,395 | 819 | 603 | 447 | 7,635 | 5,676 | 2,248 | |||||||||||

| Customer Call Back | 3,703 | 468 | 873 | 1,343 | 377 | 507 | 684 | 413 | 467 | 4,825 | 15,630 | 5,694 | |||||||||||

| Unidentified customer numbers | 551 | 856 | 600 | 753 | 389 | 162 | 522 | 239 | 237 | 1,151 | 902 | 431 | |||||||||||

| Outbound 2021 | |||||||||||||||||||||||

| Total Outbound Calls Placed | 3,766 | 1,683 | 6,519 | 9,217 | 7,987 | 14,685 | 13,329 | 12,627 | 10,584 | 6,429 | 2,625 | 4,283 | |||||||||||

| Average Calls Placed per day (Week Days) | 188 | 84 | 326 | 461 | 400 | 735 | 667 | 631 | 530 | 321 | 131 | 164 | |||||||||||

| Average Talk Time (MM.SS) | 2.33 | 2.39 | 2.13 | 4.13 | 4.17 | 4.03 | 4.09 | 4.07 | 3.15 | 4.39 | 3.39 | 3.07 |

| Jan. | Feb. | Mar. | Apr. | May | Jun. | Jul. | Aug. | Sep. | Oct. | Nov. | Dec. | ||||||||||||

| None voice service – ChatBot | 231 | 223 | 239 | 153 | 289 | 281 | 313 | 344 | 400 | 352 | 877 | 958 | |||||||||||

| Video calls | 26 | 20 | 24 | 15 | 66 | 106 | 74 | 49 | 66 | 51 | 72 | 42 |

Customer Experience Unit

In addition to the Contact Centre, the Customer Experience Unit is a centralised section that handles all customer complaints and inquiries, which it directs to the Bank through multiple channels.

The Unit is tasked with redirecting complaints and inquiries to the appropriate department or branch, and ensuring their resolution within the stipulated Service-Level Agreements (SLAs). The Complaint Management System was launched to track complaints, inquiries and service requests, which enables the Unit to assist staff across the Bank’s branch network to achieve optimum service levels.

The Customer Experience Unit carries out a series of programmes to evaluate and monitor the level of customer-centricity of the Bank. These include a bank-wide Mystery Shopper programme that allows the Bank to acquire unique insights into the satisfaction levels of customers, evaluating them with their perception and expectations. Customer experiences are regularly evaluated across areas such as customer care, sales drive, professionalism, transparency, and the cleanliness of the branch.

Mystery Caller programmes, carried out periodically, have assisted the Bank in understanding customers’ impressions and experience, while they engage a range of transactions. The findings have been invaluable in streamlining the delivery of better first impressions and phone etiquette.

The Unit has the ongoing responsibility for embedding the value of customer-centricity in the Bank’s staff through continuous training. The Bank conducted customer service training sessions for (1,062) staff members, which constitutes (48.4%) of the overall staff. Monitoring the service levels within the Bank is of paramount importance in maintaining customer experience at the required high standards. The Unit is also focused on identifying gaps in service across the Bank, which are addressed through refresher training to ensure that service level targets are met.

Details of staff training sessions conducted, as at 31 December 2021.

| Category | Participant Count | Percentage % | ||

| Customer Service | 1,062 | 48.40 | ||

| Personality Development | 79 | 3.6 | ||

| ELearning | 30 | 1.37 | ||

| Total Staff | 1,171 |

Details of the orientation programmes conducted.

| Category | Participant Count | Percentage % | ||

| Orientation | 258 | 11.76 |

During 2021, the Unit carried out analyses of the root cause of complaints, and focused on implementing preventive measures. The Complaint Management System has now been upgraded to enable customers to receive complaint/inquiry/service request reference numbers via SMS.

“International Customer Service Week”, which is commemorated worldwide, was observed by the Bank with a series of programmes organised by the Customer Experience Unit. Service Ambassadors have been appointed across the branch network to enhance customer service. Training programmes and bank-wide communications were also organised to emphasise and inculcate the importance of customer service among staff members. Branches were also included for refresher trainings during this week.

Customer Privacy

Protecting the privacy of customers is crucial to build trust and strengthen relationships. Taking this objective to heart, DFCC Bank considers the privacy of customers as being of utmost importance, making every effort in this regard. DFCC Bank harnesses the latest digital infrastructure to secure its systems and processes across all banking transactions. The new Core Banking system that will power the Bank’s products and innovations, has a host of features that take the concept of customer privacy to the next level.

Customer privacy is an integral aspect of the Bank’s Employee Code of Conduct. Staff members are provided extensive training to instil in them the importance of protecting the privacy of customers, in order to observe and adhere to the secure systems and procedures of the Bank.

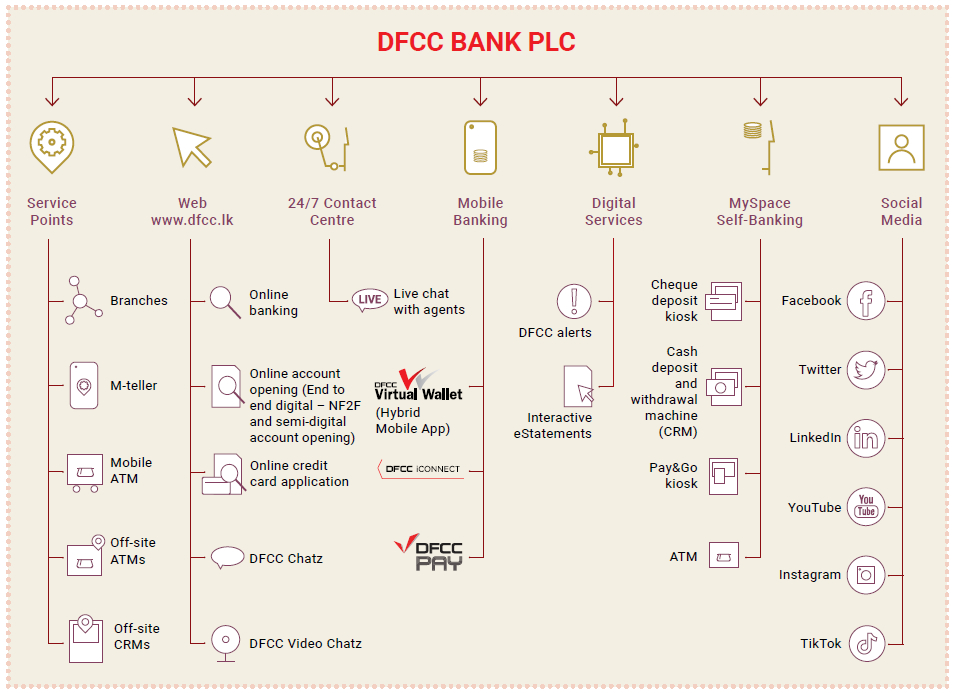

Multichannel Customer Touchpoints

Customer journeys differ from individual to individual, across a wide range of channels and touchpoints. This makes it harder to reach out to diverse segments which comprise the target audience of DFCC Bank. Utilising an extensive network of touchpoints, ranging from conventional branch network to Internet and mobile-enabled digital platforms such as DFCC MySpace, DFCC Virtual Wallet, DFCC Pay, DFCC new Retail Online and Mobile banking, and DFCC iConnect, the Bank has been able to reach out to customers with greater effectiveness.

The practical application of the Bank’s digital-first approach achieved realisation during the frequent lockdowns, and the need to maintain social distancing. During this period, customers were compelled to rely on the Bank’s digital touchpoints to engage in a virtual banking experience with digital customer onb-oarding. The mobile ATM service also provided convenient access to ATM services to identified locations and Mobile Tellers visited customers to collect cash and offer withdrawal services.

The Bank understands the varying needs of different customers, which has resulted in the provision of banking services through multiple channels and avenues, ranging from conventional island-wide branches, to various digital channels. The digital footprint and transactions of the Bank were considerably increased during the year with DFCC My Space, which includes ATMs, CRMs, cheque deposit kiosks and Pay&Go machines. Large corporations and SMEs were assisted through the DFCC iConnect payments and cash management solution.

The New DFCC Online BANKING functions consist of the following features

The new DFCC Online Banking (DFCC Online) gives you complete control over your finances with a variety of banking services at your fingertips, allowing you to manage your accounts 24/7 anytime, anywhere. The customers are empowered to do banking online with a wide array of services such as create goal setting savings, open Fixed Deposits and Savings Accounts, block your Credit Cards, configure required DFCC alert services and select your own preferred user ID.

Product Responsibility

DFCC Bank approaches product design from the viewpoint of the customer, incorporating many features that correspond with customer utility, accessibility, responsibility and convenience, in addition to the ability to confer a competitive advantage. The Bank emphasises ethical product design, adhering to the necessary statutory and compliance requirements before introducing a new product to the market.

While customers in the modern era are concerned with quality and service, they also show a marked inclination towards knowing all the relevant facts before making a purchase decision, or initiating a business relationship with an institution. This fact is rigorously adhered to by DFCC Bank, which emphasises the provision of transparent and relevant information to customers. Product and service-related information is available in all three languages, which is backed by employees who have been trained to provide more information where necessary. The Bank also conducts regular events through its branch network to educate current and potential customers about the features of its products and services.

Marketing Communications

The communications strategy adopted was based on broadening the reach through the use of traditional media as well as digital marketing with the increase in Sri Lankan’s consumption of social media. The trilingual approach in communication has facilitated to reach out to all segments across the country, creating the much-needed awareness that DFCC Bank offers a range of product propositions and services in the financial industry. Governed by the Banks Communications and Social Media Policies, communication to all stakeholders are carried out in line with the regulatory requirements at all times.

During the year under review, the Bank carried out a series of brand-building initiatives as well as product specific campaigns with a key focus on digital. Due to the ongoing pandemic even though a fewer number of physical events were conducted, online marketing activities in the form of webinars, forums, customer engagement initiatives etc., were carried out.