Investor Capital

Shareholder profile

The Bank had 10,595 shareholders as at 31 December 2021 (corresponding to a figure of 11,526 as at 31 December 2020), with 320,522,436 shares in issue. Institutions make up approximately 74.3% of the Bank’s share capital. 83.9% of the Bank’s share capital is held by local shareholders, both institutional and individual.

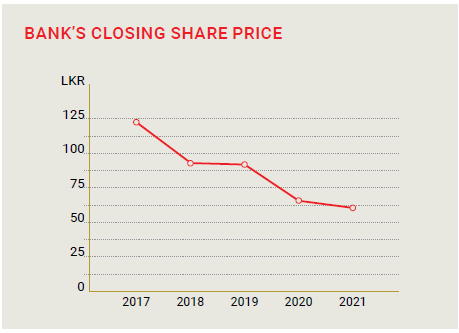

Share information

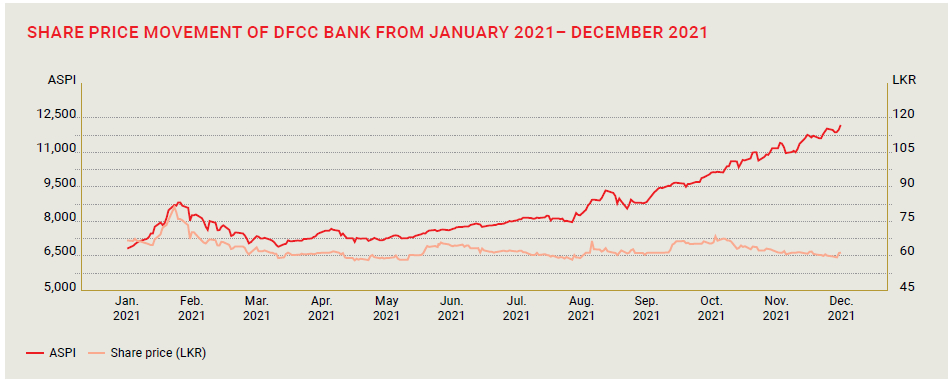

DFCC Bank share price information for the period

1 January 2021 to 31 December 2021.

|

1 January to 31 December 2021 |

1 January to 31 December 2020 |

|

| Price indices ASPI | 12,226.01 | 6,774.22 |

| S&P SL20 | 4,233.25 | 2,638.10 |

| Share price | ||

| Lowest price (LKR) | 56.30 | 47.90 |

| Highest price (LKR) | 80.40 | 91.80 |

| Closing price (LKR) | 60.00 | 65.30 |

| Market capitalisation Value (LKR Mn) | 19,231 | 19,982 |

|

Percentage of total market cap (%) |

0.35 | 0.67 |

| Rank | 56 | 37 |

| Value of shares traded Value (LKR Mn) | 2,404 | 6,379 |

| Percentage of total market turnover (%) | 0.21 | 1.61 |

| Rank | 71 | 13 |

| Days traded Number of days traded | 240 | 209 |

| Total number of market days | 240 | 209 |

| Percentage of market days traded (%) | 100 | 100 |

| Frequency of shares traded Number of transactions | 25,111 | 42,692 |

| Percentage of total frequency | 0.32 | 1.39 |

| Rank | 76 | 39 |

Investors are a key stakeholder in the Bank’s value creation process. One of the core objectives of the Bank is to maximise investor wealth by providing sustainable, long-term returns.

Distribution of shareholding

Categories of shareholders

| As at | 31 December 2021 | 31 December 2020 | |||||||||

| Shareholding, % | Foreign | Local | Total | Foreign | Local | Total | |||||

| Individual | 10.10 | 13.34 | 23.44 | 10.11 | 15.56 | 25.67 | |||||

| Institutional | 5.94 | 70.62 | 76.56 | 5.97 | 68.36 | 74.33 | |||||

| 16.04 | 83.96 | 100.00 | 16.08 | 83.92 | 100.00 | ||||||

The Bank regularly engages with its investors and they are actively involved in shaping the Bank’s corporate behaviour.

Distribution of shareholding by size

| As at | 31 December 2021 | 31 December 2020 | ||||||||

| Share range | Number of shareholders | Number of shares | Total holding percentage | Number of shareholders | Number of shares | Total holding percentage | ||||

| 1 – 1,000 | 6,399 | 1,783,326 | 0.55 | 6,826 | 2,071,399 | 0.68 | ||||

| 1,001 – 10,000 | 3,513 | 9,577,349 | 2.98 | 3,892 | 11,049,396 | 3.61 | ||||

| 10,001 – 100,000 | 577 | 15,025,500 | 4.68 | 701 | 18,399,594 | 6.02 | ||||

| 100,001 – 1,000,000 | 83 | 20,349,933 | 6.36 | 85 | 20,857,298 | 6.81 | ||||

| Over 1,000,000 | 23 | 273,786,328 | 85.43 | 22 | 253,619,563 | 82.88 | ||||

| 10,595 | 320,522,436 | 100.00 | 11,526 | 305,997,250 | 100.00 | |||||

Public holding as at 31 December 2021

| As at | 31 December 2021 | 31 December 2020 |

| Public holding percentage (%) | 62.5 | 62.6 |

| Number of public shareholders (Nos.) | 10,579 | 11,511 |

| Float adjusted market capitalisation (LKR Mn) | 12,024 | 12,500 |

| Applicable option as per CSE Listing Rule 7.13.1 (a) | Option 1 | Option 1 |

Twenty major shareholders of the Bank as at 31 December 2021

| As at | 31 December 2021 | 31 December 2020* | ||||

| Name of Shareholder/Company | Number of shares | Percentage | Number of shares | Percentage | ||

| Hatton National Bank PLC A/c No. 1 | 47,789,949 | 14.91 | 45,624,242 | 14.91 | ||

| Bank of Ceylon No. 2 A/c | 40,082,584 | 12.51 | 38,266,153 | 12.51 | ||

| Mr M A Yaseen | 32,052,242 | 10.00 | 30,599,724 | 10.00 | ||

| Sri Lanka Insurance Corporation Ltd. – Life Fund | 29,057,943 | 9.07 | 27,741,118 | 9.07 | ||

| Employees’ Provident Fund | 25,677,509 | 8.01 | 24,513,876 | 8.01 | ||

| Melstacorp PLC | 23,585,521 | 7.36 | 22,516,691 | 7.36 | ||

| Seafeld International Limited | 18,668,111 | 5.82 | 17,822,125 | 5.82 | ||

| Mr H H Abdulhusein | 9,530,000 | 2.97 | 9,000,000 | 2.94 | ||

| People’s Leasing & Finance PLC/Don & Don Holdings (Pvt) Limited | 8,981,956 | 2.80 | 4,673,501 | 1.53 | ||

| Renuka City Hotels PLC | 7,298,813 | 2.28 | 6,968,052 | 2.28 | ||

| Renuka Hotels PLC | 4,292,082 | 1.34 | 4,097,577 | 1.34 | ||

| Employees’ Trust Fund Board | 4,202,087 | 1.31 | 4,011,661 | 1.31 | ||

| Seylan Bank PLC/Senthilverl Holdings (Pvt) Limited | 3,320,080 | 1.04 | 1,333,476 | 0.44 | ||

| Akbar Brothers (Pvt) Limited A/c No. 1 | 2,844,533 | 0.89 | 2,599,019 | 0.85 | ||

| Cargo Boat Development Company PLC | 2,632,342 | 0.82 | 2,513,052 | 0.82 | ||

| Anverally International (Pvt) Limited | 2,582,161 | 0.81 | 2,056,639 | 0.67 | ||

| Sri Lanka Insurance Corporation Limited – General Fund | 2,269,393 | 0.71 | 2,166,551 | 0.71 | ||

| Stassen Exports (Pvt) Limited | 1,998,639 | 0.62 | 1,908,067 | 0.62 | ||

| Deutsche Bank AG as Trustees to Assetline Income Plus Growth Fund | 1,714,384 | 0.53 | 654,102 | 0.21 | ||

| Crescent Launderers and Dry Cleaners (Pvt) Limited | 1,562,154 | 0.49 | 1,491,362 | 0.49 | ||

| Total of the 20 major shareholders | 270,142,483 | 84.29 | ||||

| Other shareholders | 50,379,953 | 15.71 | ||||

| Total | 320,522,436 | 100.00 | ||||

* Shareholding as at 31 December 2020 of the twenty largest shareholders as at 31 December 2021.

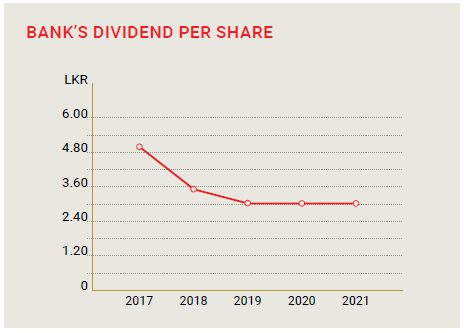

Return to shareholders – Bank

| Description | 2021 | 2020 |

| Profit for the year (LKR Mn) | 3,222 | 2,388 |

| Return on total assets (%)* | 0.92 | 0.79 |

| Net assets per share (LKR) | 152.83 | 161.30 |

| Earnings per share (LKR) | 10.14 | 7.83 |

| Dividend per share (LKR) | 3.00 | 3.00 |

* After eliminating fair value reserve.

Financial return

DFCC Bank strives to regularly provide high shareholder returns through profitable and sustainable performance. The Directors approved a first and final dividend of LKR 3.00 per share by way of a scrip dividend for the year ended 31 December 2021.

Dividends are based on growth in profits, while taking into consideration future cash requirements and the maintenance of prudent ratios.