Operating Environment

Global Economy

The impact of the COVID-19 pandemic is expected to continue into the coming year and beyond despite the rapid vaccination drive and booster shots administered, especially across developed countries. The outbreak of the Delta variant effectively ended these countries’ goals of achieving herd immunity. Their present aim is to bring the pandemic down to the level of an “endemic”, which would facilitate a semblance of normalcy in resuming large-scale economic activities. Developing countries continue to face the brunt of the pandemic due to insufficient access to vaccines, which will hinder global economic output. Further mutations of the virus make future economic scenarios hard to predict.

While the pandemic continues to cast its shadow across the world, in terms of lives lost and financial setbacks, the global economy has displayed remarkable resilience. The International Monetary Fund (IMF) expects the global economy to grow by 5.9% in 2021, slowing down to 4.9% in 2022, and levelling out at about 3.3% in the medium term. The upward trajectory of growth across Europe, China, and India is anticipated to stay the course throughout 2021, taking a slight dip in 2022. The IMF further states that Emerging Markets and Developing Economies (EMDEs) could experience growth of 6.4% in 2021, which may slow down to around 5.1% in 2022.

Meanwhile, in the USA, the S&P 500 index has more than doubled since the pandemic-induced decline which began in March 2020. Investments in equity funds have risen to about USD 900 Bn in 2021, exceeding the combined total from the past 19 years. However, with the emergence of new strains of the virus, with potentially more transmissible and virulent mutations, the projected outlook for US economic growth has been cut to around 3.8% in 2022 by certain leading US banks.

5G networks are being rolled-out throughout developed countries, which will substantially improve the implementation of emerging technologies such as Artificial Intelligence, Machine Learning and the Internet of Things. In addition, the growth of quantum computing, availability of supercomputing on the cloud, developments in electric and autonomous vehicles, investments in renewable fuels and various other technological advances could have far-reaching, exponential consequences on the world economy, as well as the environment.

Though the overall outlook seems positive worldwide, several sectors continue to languish, most notably tourism. The anticipated “revenge travel” phenomenon may not reach its full potential due to concerns about COVID-19 transmission, especially to EMDE destinations, where vaccination levels and access to medical care are relatively low. This will have a strong, negative impact on employment generation and foreign exchange inflows in these regions. Inflation is also expected to decrease to pre-pandemic levels in developed countries, while it could continue in EMDE economies during 2022. Supply chain issues and increases in fossil fuel prices could spell trouble in the year ahead.

On the political front, the continuing standoff between the US/EU and China/Russia could have severe repercussions on the global economy.

Sri Lankan Economy

Recovery of the Sri Lankan economy continues to display a classic “K-shaped” pattern, though two years have passed since the start of the global health crisis. Merchandise exports have bounced back to nearly pre-pandemic levels with projected earnings of more than USD 12 Bn, and a few sectors such as the financial sector and telecom have fared considerably well. In contrast, tourism which generates direct and indirect employment to many continues to be in the doldrums, with limited potential for recovery in the near future. The drop in tourism-related revenue, as well as a nearly 50% decline in foreign remittances in 3Q 2021, has triggered off a crisis situation, spilling over to many sectors of the economy. Import restrictions have further reduced tax revenue, as nearly a half of the Government’s tax coffers is derived from import-related taxes. It should be noted that inward remittances is the country’s largest foreign exchange earner, while tourism stands as the third largest.

The budget deficit for 2022 is expected to be 8.8%, which is to be funded through local sources. According to the CBSL, Headline inflation, as measured by the year-on-year (YoY) change in the National Consumer Price Index (NCPI, 2013=100), increased to 11.1 % in November 2021, while core inflation (YoY), which reflects the underlying inflation in the economy, increased to 8.8%.

Sri Lanka’s outstanding foreign debt has reached a critical position, with total outstanding at USD 35.1 Bn as at April 2021, while the country will be required to repay at more than USD 4.0 Bn per annum in foreign loans, up to 2025 and beyond. The debt-to-GDP ratio could reach 110% by end-2021. As a consequence, Sri Lanka’s sovereign rating has been downgraded by Fitch Ratings, S&P, as well as Moody’s to “Substantial Credit Risk”. While making international borrowings more expensive, this can also dampen foreign investor confidence. A weak balance of payment situation marked by low foreign exchange reserves, and high inflation remain as causes for concern.

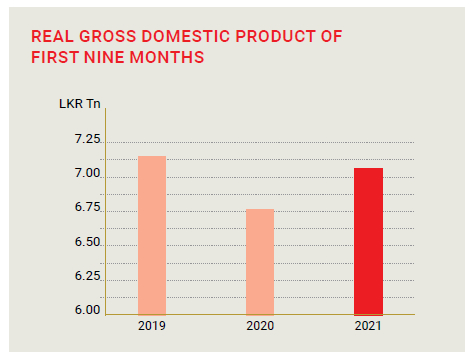

On a positive note, the country’s economy has grown by 4.4% in the first nine months of this year, in spite of a contraction of 1.5% in 3Q, according to the Department of Census and Statistics. Manufacturing and service sectors expanded in November 2021, recording an index value of 61.9 on the Central Bank’s Manufacturing Purchasing Managers’ Index (PMI) Survey.

Source: Department of Census and Statistics (2021)

Banking Sector

The banking sector has displayed a remarkable ability to flourish even during turbulent times, registering credible growth despite a daunting regulatory environment, foreign currency restrictions and depressed economic situation. Total assets have also grown by 17.6%* during the year under review.

As the Government introduced a low interest regime to spur economic growth, deposits were expected to decline in the banking system. However, due to spending restrictions caused by the lockdowns, as well as the unfavourable investment climate, individuals and businesses which had surplus liquid assets ploughed them back into deposits. Overall, deposits grew 18.2%* YoY 2021 across the sector, boosting up liquidity levels and providing the resources needed to support credit growth.

The growth in loans and advances coupled with surplus liquidity in the market contributed to total banking sector net interest income growth. Net interest margin (NIM) also registered an increased from 3.1% to 3.4% in the period under review compare to the corresponding period in 2020. Restrictions on the import of motor vehicles will continue to have an adverse effect on the leasing business, which contributes substantially to the Bank's revenue.

On the positive side, the pandemic has catapulted digital adoption among customers by several years. Banks, as well as customers, embraced new technologies with equal enthusiasm, helping manage cost-to-income ratios, and improving efficiencies. This period also led to significant positive developments such as the reduced need for brick-and-mortar operations during lockdowns, conscious cost-cutting and deferment of investments in physical branches, in addition to more customer on-boarding and interactions through digital platforms. Growth of the sector was further enabled by capital augmentation (organic and inorganic) by banks, as well as the availability of low-cost debt in Sri Lankan Rupees and foreign currency. Overall relaxation in monetary policy, reduction of the Statutory Reserve Ratio (SRR) and policy rates by the CBSL were effective in lowering borrowing costs and increasing liquidity in the money market, which further aided the performance of the banking sector.

*All figures are calculated and compared up to the first nine months

Outlook

Among the adverse consequences caused by the pandemic, are shortfalls in foreign currency earnings and reserves, which have placed a severe strain on the Sri Lankan economy. A number of initiatives undertaken by the Government to address dwindling foreign exchange reserves may bear fruit in the short term, though more ambitious programmes will be required to ensure long-term stability. Anticipated Foreign Direct Investments (FDIs) into construction, infrastructure, machinery, and new ventures will also need to materialise. Such FDIs will generate employment, and help build foreign exchange in the long term.

The banking sector which was in a position to expand its lending portfolio to hitherto unreached levels due to the availability of surplus liquidity, may find a tougher operating environment with dwindling liquidity and foreign currency shortages impacting the scale of their operations. The Government could support overcoming this situation by ensuring sufficient market liquidity and facilitating inflow of foreign currency into the country. This could play a key role in stimulating economic growth. However, net credit to the Government, which stands at LKR 5.8 Tn as at September 2021, up 27.3% YTD needs to be factored in, when evaluating future growth prospects. Further, factors which could impact Sri Lanka’s banking sector include: the maximum interest rate on housing loans at 7% for salaried individuals, 20% minimum lending growth target for the Micro, Small and Medium Enterprise (MSME) sector, and the domestic industrial and business policy orientation of the Government.

Prospects for 2022 can be viewed with cautious optimism, as improvements in tourism-related revenues and resurgence in inbound remittances could have a positive impact on the economy. The rapid vaccination drive is also expected to have a long-term progressive effect on economic growth in the year ahead. Sri Lanka could look forward to a relatively stable year ahead, if adequate funding can be secured on time to meet foreign debt obligations. This can have a positive, cascading effect on the entire economy.