Financial Capital

Financial performance

Overview

DFCC Bank continued its commitment to serving its customers across the country, delivering high-quality uninterrupted banking services, despite unprecedented challenges faced due to the pandemic resulting in volatility and economic slowdown. This hard work is attested by the global recognition that DFCC Bank received from Global Brands UK, being recognised as both the “Most Trusted Retail Banking Brand” and the “Best Customer Service Banking Brand” in Sri Lanka for 2021, in the ‘’Banking and Finance” category.

With the objective of becoming one of Sri Lanka’s most customer- centric digitally enabled banks by 2025, and in line with the Bank’s corporate strategy, the T24 Temenos new Core Banking System was implemented on 21 October 2021, along with a functionally rich online banking platform. The transition to the new core banking system will offer customers a digitally enabled, best in class banking service that is flexible and agile.

The Bank was able to achieve expected growth as a result of executing a focused strategy, driven by its purpose. The core objective being to help people and businesses prosper by embracing change through technological transformation, in order to continue to seize new opportunities resulting from the challenges of the pandemic.

The Bank implemented several concessionary schemes to support customers affected by the pandemic, helping them to emerge stronger, through numerous moratoriums, relief measures and advisory support and services, in accordance with the directives issued by the Central Bank of Sri Lanka.

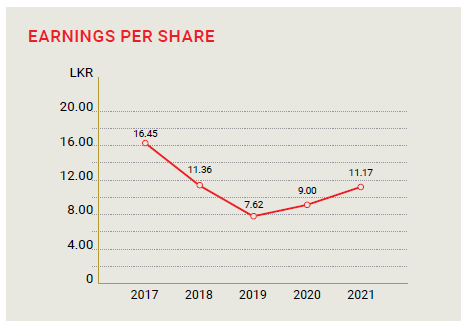

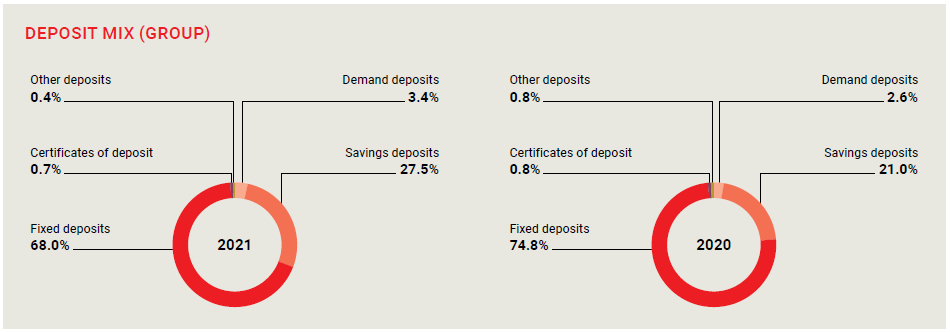

As a result of this focused approach and agile maneuvering, DFCC Bank was able to successfully conclude the year ended 31 December 2021, having delivered robust performance and growth, amidst a challenging economic environment. The Bank’s total assets increased by LKR 20,428 Mn and recorded a growth of 4% from December 2020. This constitutes a loan portfolio growth of LKR 63,991 Mn to LKR 365,901 Mn compared to LKR 301,909 Mn as at 31 December 2020, recording an increase of 21%. The Bank’s deposit base as at 31 December 2021 increased to LKR 319,861 Mn from LKR 310,027 Mn as at 31 December 2020, a growth of 3%. The Bank’s CASA ratio which represents the proportion of low-cost deposits increased to 31.25% by 31 December 2021 compared to 23.8% in December 2020. Profit after tax of the Bank grew by 35% to LKR 3,222 Mn, recording a growth in Earnings Per Share (EPS) by 29% during the year 2021.

Income Statement analysis

Profitability

DFCC Bank PLC, the largest entity within the Group, reported a Profit Before Tax (PBT) of LKR 4,326 Mn and a Profit After Tax (PAT) of LKR 3,222 Mn for the year ended 31 December 2021. This compares with a PBT of LKR 3,398 Mn and a PAT of LKR 2,388 Mn in the previous year.

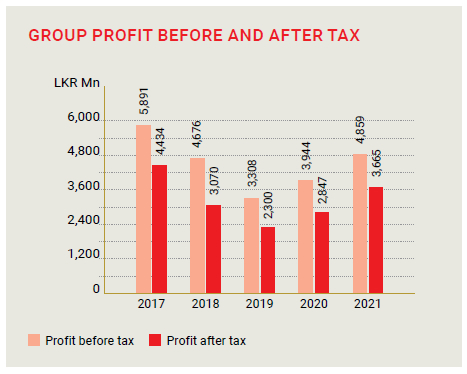

The Group recorded a PBT of LKR 4,859 Mn and PAT of LKR 3,665 Mn for the year ended 31 December 2021 as compared to LKR 3,944 Mn and LKR 2,847 Mn respectively in 2020. All the member entities of the Group made positive contributions to this performance.

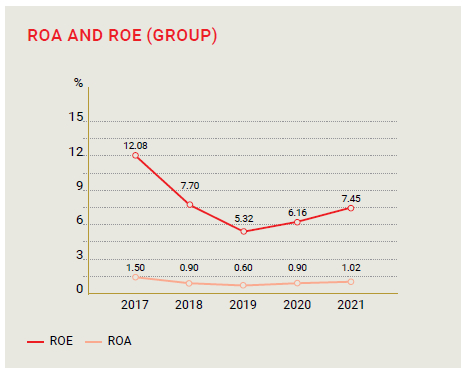

The Bank’s Return on Equity (ROE) improved to 6.55% during the year ended 31 December 2021 from 4.93% recorded for the year ended 31 December 2020. The Bank’s Return on Assets (ROA) before tax for the year ended 31 December 2021 is 0.92% compared to 0.79% for the year ended 31 December 2020.

Net interest income

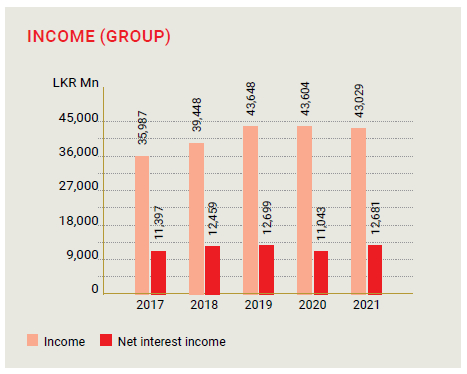

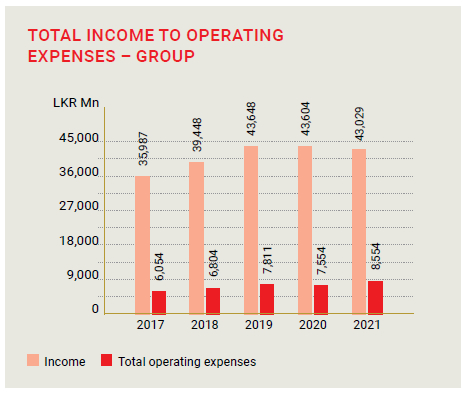

The Bank’s total income for the year 2021 was LKR 42,649 Mn compared to LKR 43,300 Mn in the previous period. Interest income accounted for 86% of the total income of the Bank. The Bank recorded LKR 12,653 Mn in Net Interest Income (NII), which is a 15% increase year-on-year primarily due to an increase in AWPLR by more than 194 bps over the past 12 months. This contributed to increase in interest margin from 2.53% in December 2020 to 2.66% in December 2021.

Fee and commission income

The Bank staff at Head office and across branch network working continuously over the year has helped the Bank to increase non-funded business. This effort was fruitful as it resulted in an increase in net fee and commission income to LKR 2,596 Mn for the year ended 31 December 2021, up from LKR 2,061 Mn in the comparative year.

Fees generated from loans and advances, credit cards, and fees collected from trade accounted for the majority of the fee and commission income.

NET GAIN FROM DERECOGNITION OF FINANCIAL ASSETS

A gain of LKR 1,325 Mn was recorded during the year by disposal of selected treasury bill and bond holdings, originally categorised under fair value through other comprehensive income (FVOCI), with the objective of cash flow management to support loans and advance growth in line with projections. The action also goes in tandem with the bank’s expectations with regard to the domestic interest rate trend, going forward.

Impairment charge on loans and other losses

Impairment provision for the year ended 31 December 2021 was LKR 4,485 Mn compared to LKR 3,298 Mn in the comparable year. NPL ratio increased from 5.56% in December 2020 to 5.60% in December 2021 and impaired loan (stage 3) ratio increased from 2.80% to 3.03%. In order to address the current and potential impact of Covid-19 and other prevailing economic conditions on lending portfolio, the Bank has made adequate impairment provisions as at 31 December 2021 by introducing changes to internal models to cover unseen risk factors in the highly uncertain and volatile environment including additional provisions made for the exposures to risk elevated sectors.

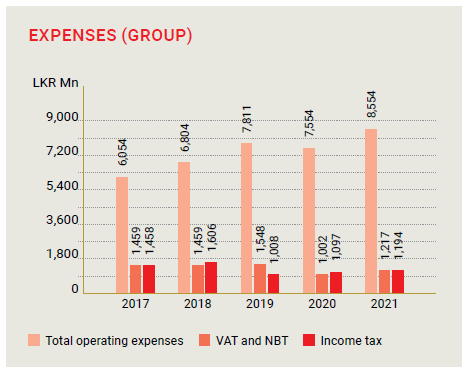

Operating expenses

During the year ended 31 December 2021, the Bank’s operating expenses increased from LKR 7,387 Mn to LKR 8,381 Mn compared to the previous year mainly due to increase in transport cost provided to its staff due to restrictions in public transport and all other expenses incurred in keeping safe and healthy environment within Bank premises to support client engagements. During the year the Bank also created multiple channels to enhance the service delivery to customers through a strong digital drive providing access to uninterrupted banking services during these trying times. This resulted the increase in IT related expenses with the infrastructure upgrades. The process automation and workflow management systems introduced during this year facilitated effective cost control measures which resulted in managing the operating expenses at these levels.

Profit After Tax (PAT)

The Bank recorded a PAT growth of 35% to LKR 3,222 Mn for the year 2021 compared to LKR 2,388 Mn in year 2020. The Bank’s total tax expense, which includes financial, services VAT (15%) and income tax (24%), is LKR 2,322 Mn for the year ended 31 December 2021. As a result, the Bank's tax expense taken as a percentage of operating profit for the year stood at 41.9%.

Financial position analysis

Assets

Despite the challenges faced by the economy and the banking sector, DFCC Bank’s total assets increased by LKR 20,428 Mn, recording a growth of 4% from December 2020.This constitutes a loan portfolio growth of LKR 63,991 Mn to LKR 365,901 Mn compared to LKR 301,909 Mn as at 31 December 2020, an increase of 21%. Following the Bank’s prudent lending policies, it did not pursue aggressive growth, particularly to sectors that exhibited stress. The Bank has implemented a number of relief schemes in line with the directives from the Central Bank of Sri Lanka to support those customers affected. The Bank’s net asset value per share has decreased by 5% to LKR 152.83 from LKR 161.30 in 2020.

Liabilities

The liabilities increased by 5% over the previous year to LKR 436,519 Mn as at the year end. The main increase was due to the substantial growth in other borrowers of LKR 22,742 Mn During the year, the Bank was able to raise long term funding of USD 150 Mn from the United Stated International Development Corporation, which mainly contributed to the increase.

The Bank’s deposit base also experienced a growth of 3%, recording an increase of LKR 9,834 Mn to LKR 319,861 Mn from LKR 310,027 Mn as at 31 December 2020. This resulted in recording a loan to deposit ratio of 114%. Further CASA ratio improved to 31.25% as at 31 December 2021. Funding costs of the Bank were also contained by using medium to long-term concessionary credit lines. When these concessionary term borrowings are considered, the CASA ratio further improved to 36.47% as at 31 December 2021.

DFCC Bank continued its approach to tap local and foreign currency related, long-to-medium-term borrowing opportunities.

Equity and compliance with capital requirements

DFCC Bank’s total equity is maintained at LKR 49 Bn from year 2020 to year 2021 with the recorded profit after tax of LKR 3.2 Bn.

In order to support future growth as a full-service retail bank, the Bank has consistently maintained a capital ratio above the Basel III minimum capital requirements. As at 31 December 2021, the Bank has recorded Tier 1 and total capital adequacy ratios of 9.31% and 13.03%, respectively which is comfortably above the minimum regulatory requirements of 8% and 12% including a capital conservation buffer of 2%. In order to strengthen the capital, the Bank has announced a right issue to raise further capital of LKR 6 Bn. The Bank’s Net Stable Funding Ratio was 122.43%, which is well above the regulatory minimum of 100%.

Credit quality

Following the Bank’s prudent lending policies, it did not pursue aggressive growth particularly in sectors that exhibited stress. During the year, the Bank had a moderate growth in its loan book covering corporate, retail, and small and medium size business segments. The loan to customer portfolio of the Bank is fairly well diversified across a wide range of industry sectors with no significant exposure to any particular sector. The Bank continued to improve its pre and post credit monitoring mechanisms through changes to internal processes and timely actions. This has brought positive results in maintaining credit quality amidst the stressed economic situation.

Dividend policy

The banking industry faced many challenges during the year from both the business and regulatory fronts due to the global pandemic. The adverse business environment became constraints for the growth of returns on equity. The minimum capital requirements became more stringent with the adoption of BASEL III. The Bank’s dividend policy seeks to maximise shareholder wealth whilst ensuring there is sufficient capital for expansion as it leverages its island-wide presence and investments in technology. Accordingly, the Board of Directors has approved a final dividend of LKR 3.00 per share in the form of a scrip dividend for the year ended 31 December 2021, balancing the needs of shareholders with business plans. Accordingly, the dividend payout ratio for the year ended 31 December 2021 is over 31% on the distributable profit.

Group performance

The DFCC Group consists of DFCC Bank PLC and its subsidiaries; DFCC Consulting (Pvt) Limited, Lanka Industrial Estates Limited (LINDEL), Synapsys Limited, its joint venture company Acuity Partners (Pvt) Limited (Acuity), and its associate company National Asset Management Limited (NAMAL). LINDEL is a 31 March reporting entity whilst the others are 31 December reporting entities. For the purpose of consolidated financials, 12 months results from 1 January to 31 December 2021 were accounted for in all Group entities. Financials of the 31 March entity was subject to a review by its External Auditor covering the period reported.

The Group made a profit after tax of LKR 3,665 Mn during the year ended 31 December 2021. This is compared to LKR 2,847 Mn made in the year 2020. DFCC Bank accounted for majority of the Group profit with profit after tax of LKR 3,222 Mn, while LINDEL (LKR 238 Mn), Acuity (LKR 293 Mn), Synapsys (LKR 1.7 Mn), and DFCC Consulting (LKR 5 Mn) contributed positively by way of profit after tax to the Group. In the previous year, Synapsys, Acuity, DFCC Consulting, and LINDEL reported profit after tax of LKR 7 Mn, LKR 407 Mn, LKR 12 Mn, and LKR 208 Mn respectively. The associate company, NAMAL, contributed LKR 12.7 Mn to the Group, an increase from LKR 1.9 Mn in the year 2020. An Inter-company dividend of LKR 89.2 Mn was paid to DFCC Bank by LINDEL (LKR 85.7 Mn) and DFCC Consulting (LKR 3.5 Mn) during the year.

RETAIL BANKING AND SME

Retail Banking and SME has been the focus of relentless change and innovation worldwide. Banks are constantly seeking means of meeting challenges of the ever-evolving landscape of consumer needs and preferences. This has resulted in the introduction of new products and processes, even ground-breaking business models, in the quest to capture value and gain competitive advantage. In Sri Lanka, DFCC Bank has been at the forefront of this race to meet current and potential needs of customers through innovation and value-addition.

Meeting the needs of a wide cross-section of retail customers, DFCC Bank offers flexible financial solutions across personal loans, overdrafts, housing loans, vehicle loans, leasing and pensioners’ loans, as well as education loans. Customers can also avail themselves of a range of deposit products which meet their individual needs. The Retail Banking section has been structured as two separate units: Assets and Liabilities, with dedicated staff serving the distinct needs of both sections.

Assets

Housing Loans

Despite the adverse economic conditions and reduced income levels, home ownership has remained a priority, especially among the middle, professional and entrepreneurial classes. DFCC Bank has addressed the needs of these segments through housing loans for fixed income earners in the private and Government sectors, as well as professionals and entrepreneurs. These loans were provided for building, buying or renovating homes, purchasing plots of land or apartments.

Performance in 2021

While the construction sector as a whole has displayed a fair level of resilience, the housing sector has shown a marked decline. This was due to the lockdown-induced curtailment of economic activity, and the resultant reduction in income levels among a large cross-section of the population.

Self-employed individuals, particularly daily wage earners, and owners of SMEs continue to bear the brunt of the economic downturn, though fixed income earners have recovered to a considerable extent. The Bank has provided debt moratoriums to customers in keeping with the guidelines of the Central Bank of Sri Lanka (CBSL), while also extending this facility to those who did not meet criteria stipulated by CBSL.

The prevailing low-interest regime, intended to bolster economic activity, has also brought home-ownership within the reach of many. Making the best of the lower interest rates, the Bank added a host of attractive benefits to gather new customers who were eager to invest in residential housing and real estate. The interest rate structure has also turned the industry into a buyers’ market, as potential investors were of the view that real estate offered better returns compared to other options. Pre-approved housing loans introduced by the Bank, with credit approval within just three working days, was a further enabler of growth in this sector.

Rising above the economic challenges of the pandemic, the high-end real estate and condominium sector has continued to soar.

The Bank has a team of experienced professionals, trained throughout the branch network, who have a sound grasp of the particular needs of the real estate sector. This enables them to ensure a streamlined service that takes into account customers’ busy schedules, while also offering a doorstep or even on-site service.

The Housing Loans portfolio received a tremendous boost by way of the following:

- Introduced Structured Housing Loan product

- Launched “Let’s Go Home” Advertising campaign

- Streamlined Housing Loan process

With 146 Residencies, Thalawathugoda by JAT Living – which offers customers a capital grace period up to 4 years a special structured repayment plan to suit their requirements and early settlement fee waivers

- CANTERBURY APARTMENTS by Home Lands Skyline

- ELEXIA 3CS by Home Lands Skyline

- BLENHEIM APARTMENTS by 360 Property Developers

- TRILLIUM HAVELOCK RESIDENCIES by Trillium

- THE PALACE by Prime Lands

Outlook

Rapid urbanisation as well as the growth of the middle, professional and entrepreneurial classes has led to a rise in demand for housing units throughout the country. There is also a perceptible shift towards vertical living in the urban areas, as land values continue to rise. The implementation of various infrastructure projects in Colombo, including the Port City project, is expected to raise real estate values further. Sri Lanka’s real estate sector, which accounts for a substantial 6.1% of the total GDP grew by 1.6% in 3Q, which is considerably lower than the 5.5% registered during the June quarter last year. However, it is reassuring to note that the real estate market remains vibrant at all three levels – luxury, affordable-luxury and the lower price range. The Bank anticipates considerable growth in its housing loans portfolio in 2022.

Leasing

DFCC Bank is a pioneer in the leasing industry, and is primarily focused on providing leasing solutions for the corporate sector, executives, professionals and self-employed individuals. The Bank’s pioneering status has resulted in a strong presence in the industry, as well as enduring relationships. DFCC Leasing has been the backbone of many success stories in the SME sector, even though the continued import restrictions on vehicles as well as exorbitant vehicle prices affected leasing adversely.

Performance in 2021

Due to the economic downturn and the restrictions on vehicle imports by the Government, the Bank’s leasing portfolio contracted by 5.4% during the year 2021. In keeping with CBSL’s guidelines regarding the provision of moratoriums for those affected by the pandemic and its economic fallout, the Bank was able to provide concessions to customers across various sectors. Despite the unfavourable market conditions, the Bank was able to disburse more than LKR 10 Bn worth leasing facilities during the year under review.

While restrictions on the import of vehicles virtually ended the leasing of brand-new vehicles, the value of second-hand vehicles showed a steep rise, creating a pivotal shift in the leasing market. The Bank’s leasing product has shown considerable growth, mainly from fixed income earners as well as the SME sector. A larger portion of the leasing business has been out of Colombo.

As the pandemic situation rendered conventional leasing promotions at vehicle dealers and bank branches impossible, the Bank launched the “DFCC Leasing Flash Promo”, a 24-hour online leasing promotion. This scheme offered competitive interest rates on leasing, starting from 8.50% per annum, with a discount of 0.50% for applications received within a specified date.

DFCC Auto Loan is yet another initiative that has been well-received. This facility provides vehicle loans for up to LKR 10 Mn, with a structured repayment plan including residual value. The rollover option offers customers the option to extend the loan for up to eight years.

The introduction of an asset-based pricing model for the leasing product during the previous year has continued to make our offering more competitive in the market. Internal motivational campaigns carried out by the Bank have also yielded the desired results.

Outlook

Throughout 2021, the Bank focused on maintaining a healthy leasing portfolio, bearing in mind the difficult economic situation faced overall in the country. Seeking new market segments, while strengthening relations with existing clientele, is expected to fuel healthy growth in 2022.

Personal loans

Performance in 2021

Personal Loans surpassed all expectations, registering a significant growth of 104% during 2021.

In keeping with the varying needs of different market segments, the Bank offers a wide range of personal loans. Due to prevailing conditions such as delays in receiving salaries, salary cuts and loss of employment, the Bank had to accommodate the needs of customers who were affected. In accordance with CBSL guidelines, moratoriums were granted, while the Bank was flexible in supporting customers’ individual needs.

As movement was severely curtailed during the lockdown periods, the Bank’s timely adoption of technology played a pivotal role in offering an effective service. Certain processes had to be adjusted to meet the situation, while others requiring manual execution were deferred until the return to normalcy.

DFCC One Loan, a personal loan product, proved to be of invaluable aid to those who were impacted by the economic downturn. Salaried customers and professionals were able to consolidate their debt under an extended repayment plan, without the need to deal with multiple financial institutions. DFCC One Loan has shown remarkable promise, as evidenced by the growth shown during the past two years.

Government pensioners who were faced with urgent financial needs were offered a loan scheme that met their repayment needs by way of a comfortable monthly commitment. As Sri Lanka has a growing population of pensioners, and longer lifespans of the people, this product has considerable growth potential.

Recognising the services rendered to the nation by Government pensioners, the Bank organised an online event titled, “DFCC Garusaru Vishrama Pranama”. Highlights of this virtual event included: health tips by a specialist doctor, comedy act by popular comedians, an interactive quiz with the chance to win prizes, as well as a presentation on the “DFCC Garusaru Personal Loan Scheme”.

DFCC Pinnacle customers, who comprise our high-end segment, were given an extended loan repayment period, along with other attractive offers. Focusing on professionals, the Bank extended its product offerings to suit their requirements. This was in addition to tailor-made salary-based offerings.

Given the growth potential of the personal loan segment, the Bank will continue promoting it with innovative offerings. Digital banking will continue its role in ensuring customer convenience and service. Doorstep service, which brings immense convenience to customers, will be continued.

Gold-pledged lending

Performance in 2021

The curtailment of economic activity due to frequent lockdowns resulted in pawning of gold and gold jewellery becoming the last resort of those in need of urgent cash. The “DFCC Ranwarama” pawning facility offered throughout the Bank’s branch network enabled many to meet their cash requirements at our island wide branches.

Due to the economic difficulties posed by the pandemic, the Bank extending a helping hand to those who wished to obtain funds to meet their urgent needs. This was enabled by increasing the advances offered by the “DFCC Ranawarama” pawning facility. This scheme offered an advance of LKR 95,000 on 24-carat gold, while 22-carat jewellery received LKR 80,000, at an interest rate of 10% p.a. Gold-pledged lending registered a growth rate of 31% in 2021. Portfolio growth stood at 1.4 Bn which is the highest growth in the pawning portfolio for a single year. In addition, the Bank surpassed the milestone of 5 Bn in the pawning portfolio.

Outlook

Pawning gold not only provides cash to meet urgent requirements, it also ensures safety of the pawned items. The Bank has elevated itself above the competition by offering a superior service, which has been a key differentiator. The Bank’s Gold portfolio will be promoted with greater vigour in 2022. Due to the high prices for gold prevailing worldwide, the Bank expects a further boost in profitability from gold-pledged lending.

Liabilities Business

Retail Liabilities

The growth of CASA, Time deposits and Children’s Savings deposit products across the Bank is carried out by the Retail Liabilities Unit. Working closely with the branch network and sales team, this Unit ensures the continuous development and implementation of strategies and key initiatives to ensure the growth of the deposit products.

Performance in 2021

Overall Branch Banking liabilities which stood at LKR 214,337 Mn as at 31 December 2020, grew to LKR 241,662 Mn as at 31 December 2021.

In order to grow the deposit base and reduce the cost of funds, the Bank’s promotional activities were primarily focused on building CASA during the year. This was carried out to ensure that the lending products could be offered at competitive rates.

Deposit mobilisation was the principal goal amongst several initiatives and marketing campaigns which were carried out throughout the year. This included a special offer for senior citizens, who received a higher interest rate on their savings with the Bank. This campaign was a success, as it was considered immensely beneficial for those belonging to this particular age group. This was evident by recording 145% growth in DFCC Garusaru savings product portfolio in 2021.

As Pandemic grips the World, especially the children and adolescents were isolated resulting in adverse consequences for their mental health. The Children Savings accounts of DFCC bank sponsored and conducted virtual events such as DFCC Junior Art workshop, DFCC Junior Essay and Art Competition, which were among many in 2021 to entertain and engage the children who predominantly follow online education due to the pandemic. These events were graced by the parents/guardians and requested to continue in the next years as well.

The DFCC Teen account continues to grow. Parents want the best for their children, and help them to build a solid financial foundation, which is a significant part of their “to-do list”. Taking the media habits of teenagers, who are exceptionally tech-savvy into account, the Bank promoted “DFCC Teen” with a series of offline and online initiatives in order to increase financial literacy among teenagers.

M-Teller operation has been another success story during the past few years, which recorded LKR 3.0 Bn in 2021, the highest collection so far after launching this initiative. The number of Deposit Mobilisation Tellers as well as their efficiency has been increased to bring a substantial growth in collection.

Outlook

In-depth study of various customer segments as well as the appropriate use of technology to reach such segments is essential for the growth of deposits. The Bank will continue to focus on both these activities in order to develop unique offerings targeting the most viable and promising segments.

Offshore Banking, Trade & Institutional Business Development

The Offshore Banking, Trade & Institutional Business Development Unit is responsible to drive business growth under the respective areas across the Bank. Working closely with all business lines, this Unit ensures the continuous development and implementation of strategies and key initiatives to ensure the growth of offshore banking, trade and institutional business.

Trade business

Performance in 2021

A considerable amount of trade income was generated during the first quarter of the year from the continuous implementation of the sugar sector initiative, where several large sugar importers channelled their transactions through DFCC, based on close client engagement and relationship management. During the subsequent period, due to the prevailing unfavourable macroeconomic conditions affecting imports, high priority was given to grow exports. However, we continued our assistance to importers by accommodating their requests on a selective basis, despite the shortages of foreign currency in the market.

Several initiatives were implemented on a continuous basis by engaging business units and relevant stakeholders to tap new business opportunities in the export segment. Customised solutions and facility structuring were offered to exporters covering various sectors to add value to them in growing their businesses.

The cinnamon sector was one sector identified by the Bank considering that Sri Lanka is the largest supplier of “True Cinnamon” to the world, and an increase in the demand for Ceylon cinnamon has occurred after the pandemic, due to its health-giving properties. After visiting several cinnamon exporters on a continuous basis and understanding their requirements, export facilities and financial guidance were provided to assist them.

As a result of this initiative most of the key cinnamon exporters are now banking with DFCC as their preferred bank. The MSME supplier financing proposition has also been successfully promoted to suppliers of large cinnamon export clients to businesses from the supply chain as well.

A programme to hand over tokens and letters of recognition to cinnamon clients for their important contribution to the country’s economy was also implemented by the Offshore Banking, Trade & Institutional Business Development Unit under the guidance of CEO.

The Bank implemented a programme to recognise the efforts of its exporters for their contribution to the economy

GROUP CANELA (PVT) LTD.

Outlook

Significant growth in overall bank export limits was observed during the year where several new facilities and enhancements were approved covering exporters from multiple sectors, which is a phenomenal achievement.

Considering the prevailing macroeconomic conditions, high focus will be given to the export sector which will help to increase the Bank’s foreign currency inflows and conversions which is a critical requirement of the country as well.

CORPORATE BANKING

Expertise across diverse industry sectors, the ability to structure large and complex deals and long-term customer relationships underpin our position as a leading Corporate Bank in the country. Focusing on multinationals, large corporates, middle market enterprises, the public sector and non-bank financial institutions, the Corporate Banking Unit offers a complete and comprehensive range of banking and financial solutions. Solutions offered by the Bank’s Corporate Banking Unit includes: working capital financing, trade financing, project and term funding, corporate financing and investment banking, cross-border financing in addition to liquidity and cash management solutions.

Performance in 2021

In 2021, Corporate Banking focused on three Pillars, namely: Grow – to deliver sustainable growth, Protect – to ensure that the Banks’ interests are protected, and Take Action – to create a culture to thrive and succeed. Based on these Pillars, the Corporate Banking Unit delivered a creditable year of performance and consolidation, achieving an asset growth of 20% whilst preserving portfolio quality. Continuing its significant contribution to the Banks’ CASA base, the Corporate Banking Unit posted YoY growth of 18%. This included the acquisition of several high-value CASA customers during 2021.

Operating income recorded at LKR 3.6 Bn, despite pressure on income of both funded and non-fund base due to various concessions given during the year and prevailing economic conditions. Strong emphasis on Trade Finance and Cash Management, on-boarding quality premium segment customers, cross-selling, profitability focus and capitalising on the key growth segments in the economy enabled the Unit to record sustainable revenue and portfolio growth.

Outlook

The Corporate Banking Unit will continue to focus on the three Pillars and is positioned to benefit from the expected revival of the economy from mid-2022 onwards. Propositions are in place for customer acquisition, relationship management, promoting transaction banking and improving process efficiencies to ensure sustainable growth of the business. Aligning with the overall growth strategy of the Bank, Non-Funded Income (NFI) remains a key focus area.

Trade Finance for exporters, Working Capital, Term Funding and Sustainable Finance will be key focus areas for 2022. In partnership with the Banks’ joint venture, Acuity Partners, the Unit will look to support customers with Corporate Finance and Investment Banking services as well. The Unit will continue to focus on driving CASA in 2022, especially the acquisition of operating and current accounts of customers by leveraging the Payments and Cash Management proposition which was voted by customers as the market leader and “Best Domestic Cash Management Bank in 2021” conducted by Euromoney.

Branch Banking

As the frontline customer-facing touch-points of DFCC Bank, the branch network plays a crucial role in carrying out direct interactions with customers offering wide variety of financial solutions, transactional banking and financial advice. As DFCC expands its branch network across the island, with each region having its own specialised categories in the Retail, SME and MSME segments, the Bank’s diversity of customers will broaden accordingly.

Performance in 2021

Branch banking faced its most severe test in offering direct and streamlined services due to the restrictions imposed by curtailed transport, social distancing and the ever-looming threat of the transmission of infections. However, the branch banking team rose to the challenge across the island, offering a seamless banking experience to customers. Implementing a mobile ATM in several areas and having Bank branches open from 9.00am to 12.00 noon during the lockdown period were further ways in which DFCC Bank brought convenience into the lives of customers.

Overcoming all obstacles of an economically challenging year, Branch Banking grew 22% in loans and advances, while the retail segment grew 29%. In addition, deposits grew by 11% in 2021 with a CASA ratio of 26% in the same period.

During 2021, DFCC Bank relocated Hakmana and Rambukkana branches for the convenience of its customers.

Outlook

Categorising customers into distinct segments has enabled DFCC Bank to take a more focused approach to reaching out and meeting the needs and aspirations of each group.

With the launch/introduction of propositions in the year 2020, DFCC Bank was able to approach its retail clients with a more focused approach in 2021 to fulfil the needs and aspirations of each customer segment. Identifying the needs of a variety of segments, DFCC Salary Plus was able to fulfil the financial requirements of the mass market salaried customers while Salary Partner proposition captured the upper mass segment of customers to reach their financial aspirations. DFCC Prestige proposition contributed to offer its value proposition to the affluent segment with tailor-made banking solutions.

With the relocation of the state-of-the-art Pinnacle Centre offering much more flexibility and convenience, DFCC Bank was able to provide an unparalleled experience to its exclusive/HNW customers through its revamped proposition, with DFCC Pinnacle catering to the financial needs served by dedicated relationship managers.

DFCC “Aloka”, an exclusive financial proposition to empower females across Sri Lanka was launched on 9 December 2021, with the prime goal of enabling women to achieve their aspirations through innovative financial, non-financial solutions, and value additions that provide a holistic approach towards the economic empowerment and development of female customers. Given the health regulations of the country a Hybrid event was held at the DFCC Pinnacle Centre which was streamed live as an online event, and was witnessed by our valued customers across the country in all nine regions. DFCC Aloka proposition will add value to its female customers at every stage of their life, such as being a student, home maker, career woman, entrepreneur or senior citizen, enabling them to reach their life’s aspirations.

MSMEs

The Sri Lankan economy derives a major portion of its domestic production as well as employment generation from Micro, Small and Medium Enterprises (MSMEs). Recognising the need to foster financial inclusion of all business segments, the MSME Division of DFCC was established in 2016. DFCC has been at the forefront of responding to the banking needs of MSMEs, remaining true to its roots as a specialised development bank. The Bank fully endorses the view that MSMEs of today have the potential to emerge as big businesses of tomorrow. It is also totally focused on its role as financier and growth partner to fuel their expansion. This Division supports small and medium entrepreneurs as well as self-employed individuals to expand their businesses, while realising their goals in life.

While MSMEs are underserved by the banking sector, they are also considered a high-risk segment. However, DFCC Bank has taken the view that serving such relatively small businesses will enable the outstation branches to grow their retail base. It will also diversify the sectoral base of the Bank’s clientele. The MSME Division offers two key products. In the first category are small business loans, which DFCC has historically provided as a development bank, while the second category comprises Value Chain Financing. This is a novel approach which covers the financial needs of the entire value chain. This fosters the growth and competitiveness of all stakeholders across the value chain in a number of industries. It also makes the entire value chain more robust with the ability to scale and expand rapidly.

DFCC Bank has entered into partnerships with the CBSL and international agencies such as the International Fund for Agricultural Development (IFAD) and Smallholder Agriculture Partnership Programme (SAPP) attached to the Ministry of Agriculture. This enables the Bank to provide farmers with additional funding through grants. In addition, it helps increase productivity and savings among the farming community, while helping them improve their living standards and educate their children.

Some of the value chains where the MSME Division is actively engaged include value chain partners such as tea smallholders, tea factories, dairy farmers, milk collectors and dairy processing companies.

Financing in dairy sector through the SAPP programme has achieved immense success, granting over 1,200 loans in collaboration with seven dairy manufacturers. Apart from that over 4,000 tea smallholders were financially assisted for in-filling and replanting tea.

Staff members of the Division take care in selecting business sectors where they can create the most beneficial impact. In the case of agri-financing, priority is given to progressive farmers who use high quality inputs and sophisticated farming practices, in addition to employing workers within the community. This keeps risks associated with such a business model to the minimum, while ensuring sustainable development of the community.

Taking yet another step-in agriculture financing, in 2020 MSME Division established New Comprehensive Rural Credit Scheme (NCRCS) which is one of the main interest subsidy schemes funded by the Government of Sri Lanka. Commencing from Maha season of 2020, over 1,300 loans have been granted to the farmers who are mainly engaged in paddy, maize, turmeric, and gingelly cultivation in all parts of the country.

Performance in 2021

Though the MSME Division works mainly with tea smallholders and small-scale dairy farmers, it is on the constant lookout for new opportunities in new segments.

In 2020, the department launched a supplier financing scheme, breaking into a relatively untapped market. Furthermore, the department also introduced these customers to other products from the Bank such as deposits and cards, thus developing and contributing to the Bank’s other lines of business.

Among the worst affected by the continuing pandemic were small businesses, forcing quite a few to shut down. With the help of debt moratoriums, many were able to recover, while some have even improved their business outlook. Despite such major setbacks, the department achieved its targets during the year. The department’s portfolio has a nearly even split between agriculture and MSMEs, with half of MSME loans directed towards agriculture. The main focus of the department is on farmers who cultivate food crops and sugar cane.

While most banks and NBFIs concentrate on smaller loans to this sector, DFCC has focused on providing larger loans averaging over LKR 350,000. In addition, the department is able to process up to 400 loans per month, disbursing smaller loans. As the traditional one-on-one loan appraisal mechanism is not particularly efficient, the department has developed a new, vigorous mechanism to meet the needs of its 7,000-strong customer base representing MSMEs.

Currently, 35% of MSME customers are female. The biggest issue faced by women entrepreneurs is their inadequate financial literacy and limited access to finance. Promoting female entrepreneurship and enabling women to fully benefit from financial services is an approach that is being actively pursued by the MSME Division.

The Bank was able to implement this concept through a series of engagement programmes aimed at empowering and uplifting women entrepreneurs in the MSME sector. This programme was aimed at women entrepreneurs engaged in tea cultivation, beauty salon management, dairy farming and general cultivation, and was carried out with the assistance and guidance of experts in the relevant fields.

In November 2021, DFCC Bank signed an agreement with the United States Development Finance Corporation for USD 150 Mn. This is a significant milestone in the Bank’s endeavour to help women entrepreneurs. The tranche is part of 265 million US Dollar credit line the US-based organisation has committed to support Micro, Small and Medium Enterprises in Sri Lanka with special emphasis on women-led businesses.

Further strengthening its partnership with the corporate sector and entrepreneurs in MSMEs, DFCC Bank partnered with the Ceylon National Chamber of Industries (CNCI) for the 4th consecutive year as the Principal Sponsor and Official Banking Partner of the CNCI Achiever Awards 2021. This partnership fitted seamlessly with the Bank’s role as the preferred partner for MSMEs of Sri Lanka.

Outlook

The launch of the new Core Banking System incorporating digital workflows and a data-driven model has helped the Division to transform and transition to a more efficient and effective style of functioning. Acquiring a portfolio of relatively larger SMEs will be the main focus as the economy hopefully rebounds in the coming year. The Division has identified suppliers of agriculture exports, who deal with high volumes but are under-banked, as potential customers. Having a more customer-centric approach, in addition to cash collection at the customers’ own business premises will be the approach to be adopted in dealing with this segment.

In addition to liability products, the Division has also actively promoted leasing products, which are in great demand in this sector. In fact, this has been one of the enduring strengths of DFCC Bank over the years.

Successive governments have placed considerable emphasis on developing the MSME sector as well as the export sector, where quite a few of MSMEs are concentrated. This will help the Division to play an active role in propelling this sector on the path to greater economic success, while helping the national economy in the process.

Timely provision of debt moratoriums, as well as other facilities, enabled the branch banking team to continue supporting SMEs affected by the COVID-19 pandemic. “Saubagya COVID-19” loan scheme was one such initiative, along with “DFCC Sahanaya”, the Bank-funded credit line, which played a pivotal role in helping SMEs survive and move forward during such challenging times.

Taking forward its pledge to build a more resilient Sri Lanka, the Bank launched the “DFCC Krushibala” credit scheme for SMEs and corporates engaged in agriculture and related sectors. This scheme offered loans up to LKR 100 Mn for five to seven years at a concessionary interest rate of 7.00% per annum. Loans were offered for cultivation, livestock and dairy, agricultural processing, warehousing and enhancing storage facilities, development of commercial agriculture and hi-tech agriculture, as well as introducing/capacity enhancement of organic fertilizer manufacturing.

SMEs in Sri Lanka are dispersed across many sectors, including agriculture, exports, manufacturing, health, education and construction, playing an important role in economic growth and employment generation. The Bank will continue to provide financial and advisory services to this sector, while extending its support to SMEs which were badly affected by the pandemic.

In keeping with DFCC Bank’s sustainability goal of becoming a “Bank for Green Financing”, there will be an increased focus on promoting environmental, energy and sustainability-related projects, as well as related advisory services.

TREASURY

DFCC Bank’s Treasury function is structured on three Pillars: the Front, Middle and Back Offices.

The Treasury Front Office (TFO) is the main income generating unit. The TFO, which comprises a highly experienced team of dealers, generates revenue through trading in foreign exchange and fixed income securities, income through customer-related transactions and interest income from investment. The Unit also manages the Bank’s liquidity ratios and other key regulatory ratios. The TFO reports directly to the Head of Treasury.

Treasury Middle Office (TMO) independently reports to the Chief Risk Officer (CRO). TMO engages in risk monitoring and reporting of TFO activities on the basis of Board-approved limits, controls and regulatory guidelines.

Treasury Back Office (TBO) comes under purview of the Head of Finance/Chief Financial Officer (CFO). TBO is responsible to prepare, verify and settle all transactions carried out by the TFO.

Performance in 2021

The Treasury Unit was able to contribute significantly to the Bank’s bottom line under extremely challenging macro and micro environments. The accommodative monetary policy regime that was prevalent in the first half of the year enabled the Treasury to generate considerable revenue through capital gains by engaging in fixed income securities trading and related activities. The Treasury was well-positioned to take advantage of the rising interest rate environment through management of the maturities and investments that would help to maximise NII-based revenue.

Customer related transaction volumes were impacted due to tough economic conditions. The continuation of import restrictions imposed in 2020, island-wide lockdowns and the absence of interbank foreign exchange markets supressed potential revenues. Despite the above challenges, Treasury was able to deliver a seamless service to the customers through the use of digital channels while ensuring the achievement of said revenue targets.

In the backdrop of COVID-19 related economic setbacks and resultant sovereign rating downgrades, the external funding opportunities to the banking sector has been impacted. Despite the above, DFCC Bank has been able to raise long-term funding of USD 150 Mn from United States International Development Finance Corporation at very competitive terms. The Treasury was able to successfully hedge the proceeds of the same that will ensure steady revenue streams from on-lending activities.

Outlook

The country will continue to face several challenges in time to come due to the external sector developments, depleting forex reserves and debt obligations. Despite these strong headwinds, Treasury is confident of overcoming such hurdles while capitalising on opportunities to achieving its objectives.

Resource Mobilisation AND CAPITAL MARKETS UNIT

This Unit is managed by the Vice President Resource Mobilization and Capital Markets under the direct purview of the Head of Treasury.

The Unit’s responsibilities include, but not limited to the following:

- Sourcing of medium-term and long-term funding for the Bank which includes credit lines, syndicated loans and local and international debt issuances

- Managing the Bank’s Equity portfolio comprising of strategic and non-strategic investments, the trading portfolio, and its portfolio of Unit Trusts investments

- Managing the Bank’s Margin Trading Business as a Market Intermediary registered as Margin Provider by the Securities and Exchange Commission of Sri Lanka (SEC)

- Managing the Bank’s Underwriting Business as a Market Intermediary registered as Underwriter by the SEC

- Managing matters relating to Capital Raising for the Bank

- Coordinating with the Rating agencies with regards to the National and International Ratings of the Bank

Performance in 2021

The Unit continues to play a key role in securing funding at attractive terms, which helps the Bank’s budgeted balance sheet growth. During the period under review, the Unit raised over LKR 30,000 Mn (USD 150 Mn) in long-term funds from United States International Development Finance Corporation, which is the largest external borrowing in the history of the Bank and one of the largest by a bank in Sri Lanka during the year.

Through the Equity and Unit Trust portfolio management, the Bank was able to realise capital gains of LKR 570.08 Mn, while recording unrealised capital gains of LKR 324.25 Mn through the quoted equity portfolio. The dividend income earned during the year amounted to LKR 81.24 Mn [Excluding dividends from Commercial Bank of Ceylon PLC (CBC) and NDB Bank PLC (NDB)].

The Composition of the Equity and Unit Trust portfolio is given in Table 1.

Having taken charge of the Margin Trading operations in January 2021, the Unit was able to grow the business where the utilisation of limits grew by 5 times and the client base grew over 2.5 times.

During the year under review the Bank was able to participate in one of the Initial Public Offerings (IPO) of shares as one of its Underwriters, thus providing the much needed confidence to the investors and helping the issuer with a successful closure.

Composition of the Equity and Unit Trust portfolio as at 31 December 2021 – Table 1

| Cost LKR Mn | Fair value LKR Mn | |||

| Quoted share portfolio – Fair Value through Other Comprehensive Income (FVTOCI)* | 1,037.23 | 1,312.47 | ||

| Quoted share portfolio – Fair Value through Profit and Loss (FVTPL)** | 132.41 | 181.42 | ||

| Unit Trust portfolio** | 6.16 | 37.45 | ||

| Unquoted share portfolio | 7.30 | 216.60 | ||

| Total | 1,183.10 | 1,747.94 |

* Excluding CBC voting shares and NDB shares

** Reflects the original investment cost

Outlook

With the expectation of a continuation in the positive momentum in the Equity Market, the Unit is confident that 2022 will bring in considerable opportunities.

INTERNATIONAL TRADE AND REMITTANCES

DFCC Trade and Remittances Department consists of five units namely Imports, Exports, International Remittances, Correspondent Banking, and Offshore Banking. The well-planned strategic structure ensures efficient and streamlined day-to-day operations in delivering services to internal and external customers. Lanka Money Transfer, which handles worker remittances brought into the country, functions as a separate business unit of which operational functions are executed and monitored by Trade and Remittances.

Performance in 2021

The curtailment of economic activity due to the pandemic resulted in a considerable setback for the import, export and remittance business. The situation was further aggravated by frequent changes introduced by regulatory authorities to find solutions for Foreign Currency Liquidity shortage in the market. The widespread lock-downs and extended bans on inter-provincial travel were added burdens on an already fragile economic situation of the country.

In the face of aforesaid issues our teams of experts were able to explore new avenues to facilitate client requirements, while adhering to regulatory requirements. This innovative thinking mindset of the team was a welcome respite for this troubled sector which was already hampered by the prevailing conditions of lock-downs and restrictions. Despite aforementioned challenges, near normal business activities were recorded during the first few months of year 2021. The Bank was able to capitalize on favourable market conditions which prevailed during the first quarter before downsizing the business operations.

Despite all the setbacks, the Trade & Remittances Unit helped the Bank generate LKR 744.2 Mn and to achieve the Fee & Commission income budget allocated to trade business. The international remittance Unit was able to generate LKR 65.9 Mn from remittance business.

The nature of work processes in the Trade and Remittances Unit usually require the presence of staff in offices, as the work involves physically examining documents and meeting tight deadlines, delays of which would result in customers incurring financial losses. Therefore, even during lockdowns, sufficient staff were available at the Trade and Remittance Unit to ensure uninterrupted service to customers.

The Correspondent Banking Division played a commendable role in strengthening the existing relationships with international banks, and timely execution of trade transactions. Further consolidating the Bank’s global presence, new correspondent banking relationships were established during the period under review.

Outlook

The macro environment remains a cause of concern while the economic situation of the country itself should be viewed with cautious optimism. The market will continue to be challenging in the coming year and the Unit remains mindful of the environment to stay abreast of the latest market development. The main challenge would be the foreign currency liquidity issue in the market. However, our team of experts are well aware of market volatility and are optimistic to drive the Trade and Remittance business with the help of business units. Identifying the important business areas when facilitating trade transactions will be the way forward until the country’s FCY liquidity positions are improved.

The Bank’s commitment to digitising processes and work flows will continue to reap dividends in the years ahead. Rapid advances in technology and the very nature of conducting business across a diverse range of sectors can be inherently challenging. The team at the Trade and Remittances Unit is up to the task, constantly updating their knowledge and forming closer bonds with their ever-expanding client base.

WORKER REMITTANCES

Lanka Money Transfer (LMT) is a DFCC owned remittances system developed by Synapsys, that facilitates the transfer of funds in real time from a number of countries to any bank account in Sri Lanka. Currently, DFCC Bank has representations in 12 countries through 24 exchange companies.

Performance in 2021

Worker remittance from overseas is Sri Lanka’s largest source of foreign exchange inflow to the country, which has been mostly unaffected by the pandemic situation except for the third quarter in 2021, when there was a considerable drop in remittance inflows. The Unit processed approximately 51,592 transactions worth USD 43.47 Mn in 2021. This was an improvement on the 40,000 transactions worth USD 30 Mn carried out in 2020. The LMT platform continues to reach more countries, including UK, Japan, South Korea, Australia, Singapore, Hong Kong, and Israel.

Outlook

DFCC Remittance Services signed up with MMBL Money Transfer in October 2021, to accept money transfers through Western Union, MoneyGram, and Ria Money Transfer. In 2022, six exchange companies in Italy, Australia, Japan, and Israel will be added to the LMT platform. Worker remittances are likely to increase as many workers get back to their jobs overseas, especially in the Middle-East.

CARD OPERATIONS

Performance in 2021

With completely new working arrangements in place due to the COVID-19 pandemic, the business continued uninterrupted and was able to maximise the opportunities made available in the market.

The year was exceptional with the achievement of 50,000 Credit Cards; a milestone that was reached within a very short time span.

Moreover, the Bank expanded the Cards business by establishing a partnership with Mastercard in order to issue Credit Cards and to add value to the Merchant Acquiring Business.

While the Bank’s focus was to continue assisting cardholders through turbulent times, the in-house smart-card personalisation system was introduced which equipped the production of cards with greater efficiency. The initiative tremendously supported scaling down production costs and improving the turnaround time for a card to be issued.

Given the importance of this endeavour, customer segments were identified to spur the cardholder spending and to make the card to achieve top-of-mind recall. A 3% cash-back was offered for fuel, restaurants, overseas spend and utility for the proposition cards. In addition, numerous initiatives to grow the cardholder spend and the portfolio growth was launched. The introduction of the 0% Easy Payment Plans for a tenor of 13 months, Buy Now – Pay Later Promotions, 0% Balance Transfer campaigns and massive online and health care offers, especially to support the pandemic situation, were launched.

The largest online shopping site in Sri Lanka, Daraz recognised the Bank as the Tactical Campaign Innovator during the Daraz Payment Partner Performance Awards 2021. This award re-confirmed the Banks spirit of being innovative.

The Merchant Acquiring Business deployed over 1,000 POS terminal machines and continued to support the Bank by contributing to the CASA growth. A partnership was forged with VISA International to recruit Micro Merchants in a bid to encourage SME business to accept payment cards. The objective of the programme was to foster financial inclusion in the rural economy, and to penetrate card acceptance by offering preferential pricing to this segment. The Mastercard acceptance on the POS machines was also an added advantage that assisted with recruiting high volume merchants. Furthermore, under the guidance and initiative of Central Bank of Sri Lanka to promote and encourage cashless payments, the Bank participated in several LANKAQR campaigns across the country.

BANCASSURANCE

Bancassurance business offers an extensive portfolio of insurance and assurance products to its customers, to safeguard its mortgage assets, customer wealth and their well-being, while diversifying the Bank’s operations to drive the “Other income” portfolio.

The product portfolio includes long-term solutions such as life insurance, pension plans, higher education plans, protection covers, and wealth management solutions. Short-term solutions include asset cover products such as motor insurance, fire insurance, marine covers, machinery covers, hospitality covers, etc. The Bancassurance Unit offers hassle-free claims settlements, bespoke insurance packages, free consultations to its customer base, and product customisation to meet their specific needs and requirements.

The Bancassurance Unit works to raise awareness on personal well-being, wealth planning, wealth management, and risk mitigation associated with businesses to its customers. The Unit has a partnership with the Bank’s long-term life insurance partner, AIA Insurance Lanka Ltd., to provide Life insurance, and the General insurance solutions, which are sourced through all reputed insurers in Sri Lanka by the Bank’s appointed insurance broker.

Performance in 2021

The Bancassurance Unit initiated 5,483 life cover policies for the year 2021 and facilitated 24,242 non-life policies for the same period. The Unit successfully negotiated claims amounting to LKR 85.3 Mn for non-life policies while generating over LKR 430 Mn Annualised New Premium (ANP) for Life insurance and over LKR 1.02 Bn. Gross Written Premium (GWP) for General Insurance for the said period.

The key initiative for life insurance in 2021 was to drive small ticket policies and to this end, the Bank launched a campaign targetting salaried new recruits, which was a major success in generating long-term small policies. AIA Insurance developed an Adobe digital signature work flow so that contracts could be signed via email. This has helped to accelerate the processing of smaller policies tremendously during the lock-down period.

The DFCC-AIA CEO’s Club Awards Night 2020 and 2021 was held to recognise and celebrate the Bank’s staff for their exceptional achievements in providing protection to the Bank’s customers, via a virtual event with the participation of Bank and AIA staff members.

In 2021, General Insurance Unit, amidst challenges, have shown resilience to be on par with the aspired income target, as a result of maintaining a high level of renewals and also due to the initiation of business generation through Deceasing Term Assurance for personal financial services.

Outlook

With the continuation of restriction on vehicle imports, 2022 will be a challenging year. The Unit will target an LKR 1.25 Bn top line from General insurance business. Life insurance penetration in the country remains low, therefore the market remains ripe and the need for digital strategy development appears to be growing more urgent. To this end, the Bank is exploring several innovative options to pave way for the growth of the business. The Unit will continue targetting customers with high disposable income, enhanced appetite and buying power for insurance products as a form of investment. We will also empathise on segmented approach and offer need base solutions for different segments of customers.

Leveraging technology such as Data Analytics, Artificial Intelligence and Machine Learning to identify specific customer segments and their needs, will be the way forward. On-boarding customers through social media such as Facebook, digital channels, the Bank’s website, Virtual Wallet and ATM machines. The Bank has also considered using Call Centre and SMS platform to raise awareness among selected audiences. This will be key in 2022 as the trend from traditional bancassurance sales model, which has been heavily reliant on face-to-face interactions, has been rapidly shifting towards digitisation models.