Employee Capital

As DFCC Bank consolidates its reputation as one of the most customer-centric banks in Sri Lanka, it is imperative that its employees are among the most knowledgeable and technically competent, in keeping with its state-of-the-art, digital infrastructure capabilities and innovative products being launched. Staff members are also required to be engaged, agile and empowered in order to respond to new challenges in the emerging business environment.

The enthusiasm, adaptability and responsiveness displayed by our staff members during COVID-19 pandemic makes it abundantly clear that they are up to the task. The infrastructure and protocols in place played a key role in empowering employees to make the transition to working remotely, while continuing to provide a streamlined and efficient service.

Despite restrictions in mobility due to frequent lockdowns, the Bank continued to update the skills of staff members through online platforms for training and maintaining communication, as they worked from home. The Bank continues to emphasise and uphold the highest standards of ethical practices and the legitimate rights of employees, despite the challenges imposed by the pandemic.

Workforce Statistics

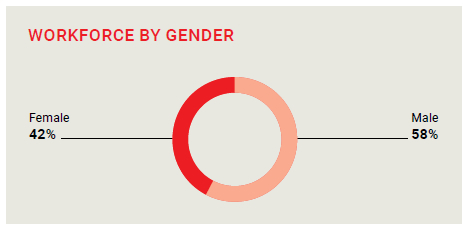

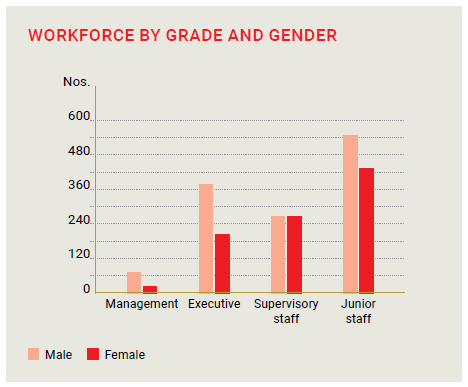

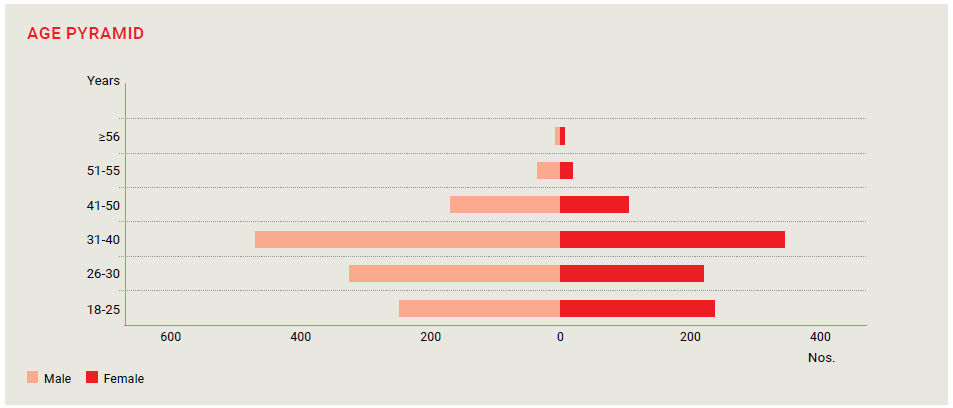

By the end of 2021, staff strength stood at 2,191 employees, with 86% in the permanent cadre, The male:female ratio amounted to 58:42. Approximately 65% of employees in the branch network are based outside the Western Province.

Given below are graphical representations of the Bank’s workforce statistics in 2021:

Workforce by Province and Gender

| Province | Number of branches | Male | Female | Total | ||||

| Central | 15 | 72 | 51 | 123 | ||||

| Eastern | 10 | 51 | 19 | 70 | ||||

| Northern | 6 | 32 | 21 | 53 | ||||

| North Central | 9 | 53 | 23 | 76 | ||||

| North Western | 11 | 61 | 49 | 110 | ||||

| Sabaragamuwa | 14 | 62 | 38 | 100 | ||||

| Southern | 23 | 99 | 81 | 180 | ||||

| Uva | 10 | 51 | 26 | 77 | ||||

| Western | 41 | 212 | 205 | 417 | ||||

| Total | 139 | 693 | 513 | 1206 |

| Number of units | Male | Female | Total | |||||

| Departments and other business units | 94 | 569 | 416 | 985 |

Resourcing

Being constantly on the lookout to employ staff of the highest calibre, in addition to be considered an employer of choice, the Bank regularly takes part in a variety of employment-related events such as held at schools, universities, and higher educational institutions. Internal initiatives such as staff referral schemes, graduate and school leaver internship programmes as well as increased focus on outsourced deployment options for non-core functions were some resourcing strategies pursued during the year.

TALENT ACQUISITION

During the year, planned expansion of the cadre, including new positions, were done on a restrained basis, where replacements were accommodated considering that Bank has consistently operated with minimal numbers. In filling vacancies, the Bank places priority on giving opportunities to internal candidates with “Expressions of Interest” circulated among staff for all vacancies. The Bank intranet, WeConnect, is updated daily with available vacancies. During the year, 402 new employees were recruited, of which 76% were in the junior cadre, and approximately 75% of them were under the age of 30 years.

Learning and development

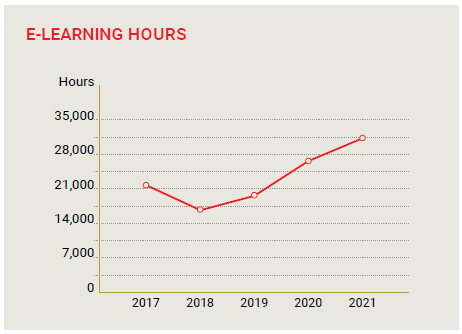

Developing our employees and ensuring they possess the requisite competencies to perform their roles at optimal levels as well as preparing them to take on higher level accountabilities in alignment with the Bank’s strategic goals continued to be a priority. Annually, supervisors engage on a one-on-one basis with their staff and together formulate individual development plans for every employee, customised to address their individual development needs. Annual and monthly training plans are formulated based on needs identified in the individual development plans as well as considering the strategic imperatives of the Bank. During the year, considering the prevailing conditions, the Bank continued to focus on provision of training through virtual platforms and deploying blended learning options.

The Bank’s upgraded eLearning platform, “eAcademy” incorporates the very latest in teaching methods and technologies, affording more flexibility for content design and data management, including mobile-enabled learning, thereby facilitating our regionally dispersed employees to learn at their own pace and in locations of their choice. During the year, over 19,200 participants attended 493 programmes, of which 95% were conducted utilising virtual platforms. Additionally, through eAcademy, employees accessed 59 technical and soft skills modules, with over 80,900 learning hours accumulated during the year.

| Number of training courses | Training participants | ||

| Online training | 467 | 19,010 | |

| On-site programmes | 26 | 243 | |

| eLearning modules | 59 | 14,931 | |

| Total number of trainings | 552 | 34,184 |

With the objective of further enhancing exposure of our employees, job rotations and transfers are arranged regularly. During the year approximately 95% of planned job role changes were implemented.

The Bank conducts certification programmes covering banking and credit operations. Additionally, employees are encouraged to pursue professional development and accelerate their career progress by obtaining banking, professional and postgraduate qualifications. The bank provides grants and loan-based assistance schemes to assist employees to pursue professional courses of study.

Career development

The Bank offers several career development programmes aimed at employees in different stages of their career trajectory, with a view to accelerating their progression. One such programme focuses on the high potential talent pool, and grooming these employees to take on higher level roles. These staff have access to customised development plans, coaching and mentoring opportunities, special assignments, broadened job scopes, advanced training etc.

Aligned with the Bank’s objective of creating a robust leadership pipeline, several new leadership acceleration programmes were launched during the year, focusing on senior managers, middle management, branch managers and female leaders. Over 100 managers received the opportunity to participate in these customised development initiatives.

In addition, a cross-section of high performing managers was also nominated for the Great Manager Award programme in which the Bank participated for the first time. This awards programme encompassed a stringent evaluation mechanism, comprising of peer and subordinate assessments as well as interviews with an external assessment panel. Through this process, 10 of our current managers were recognised as “Great Managers” while the Bank too was recognised as an Institution with Great Managers.

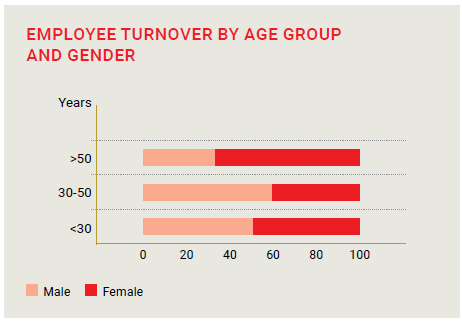

Employee Retention and Turnover

Given the high level of training and development provided to employees over the course of their careers, the Bank attaches considerable importance to employee satisfaction and retention, as part of its human capital strategy. Multiple mechanisms are in place to address employee grievances. Such as a transparent grievance escalation processes, availability of a cross functional grievance committee, availability of a digital platform with the option to maintain anonymity. Additionally, extensive employee engagement activities such as competitions, awards programmes, extracurricular events, mental and physical wellness initiatives, training and advancement programmes are conducted on a regular basis. Human resource policies are reviewed annually and revised as needed to align with the Bank’s strategic objectives and industry standards, as well as the needs of employees. Transparency and equability are accorded the highest priority in implementing such policies.

Employee retention at 92% was satisfactory. It is noteworthy that the bulk of turnover was witnessed in the contract and sales staff segments, as these segments generally tend to have higher turnover rates. The last two quarters of the year witnessed higher staff movement with migration also being a significant factor. Though the pandemic has imposed financial and economic implications, the Bank has been committed to ensuring job security, and remuneration standards. As per standard procedure, exit interviews are conducted for departing staff members. The feedback from such interviews are collated and provided to supervisors, and corrective action taken where warranted.

Communications

In recent years a series of significant changes have been made to the ways in which the Bank manages and communicates with its employees. Many of these changes are in line with the Bank’s Vision 2025 strategy to be a digital-first, customer-centric bank. Since a large number of the Bank’s employees were compelled to work from home on a roster basis, due to travel restrictions and social-distancing considerations, significant changes were adopted to work systems and processes, communication frameworks and infrastructure to ensure achievement of business needs while also accommodating the interests and welfare of employees.

The Bank’s intranet, WeConnect is an active tool through which employees can upload and react to photos, receive updated information on job vacancies within the Bank, view information on training programmes, in addition to obtaining information on Bank policies, regulatory and compliance guidelines, etc.

“Listening Wall” is a digital platform; a formalised system which enables the Bank’s employees to express suggestions for process improvements, and ideas in addition to surfacing concerns and issues. The employee feedback raised on this platform is reviewed on a monthly basis by a senior committee, using responses given and follow-up action taken where warranted.

The new cloud-based HR Information System, “People’s HR”, has played an effective role in supplementing the Bank’s human resources-related strategies, in terms of overall efficiencies, this provision, offering attendance flexibilities and conveniences to employees. The second phase of the HRIS implementation has introduced modules for performance management, talent acquisition and on-boarding. The adoption of Google Workspace as the new communications and productivity enhancement platform continues to pay rich dividends in terms of efficiencies. Other virtual platforms have also been successfully adopted as additional communication platforms to facilitate larger virtual meetings, such as the annual townhall meeting, where the Bank’s CEO engages directly with the staff. During the last year, although conducted virtually, the townhall meetings provided a very effective mechanism for the CEO to engage with employees and directly respond to their queries and concerns.

Grievance Management

The Bank takes a concerted effort to address staff grievances as and when they arise. Several grievance management mechanisms are in place to address staff concerns. The Bank’s grievance policy details redressal available to employees and the methodology for grievance escalation. The secure environment policy focuses on anti-harassment and workplace safety. These policies are readily accessible to all staff. Additionally, a Grievance Committee, comprising a cross-functional team, addresses concerns raised by employees. The Reach Out Committee, a special all-female Committee is available to assist our female employees with any personal or professional issues they may encounter. The Bank also has an open-door policy and the Senior Management, including the CEO are readily accessible to all staff while additional special “Open Days” are held throughout the year as well. The cumulative effect of such multiple grievance management mechanisms provides employees with improved ways to have their grievances addressed or escalated, while giving them the chance to decide on whom they would like to convey their concerns to.

Happiness and Well-Being

Health and safety during COVID-19

Ensuring the safety of the employees continues to be the focal HR priority. While the entire country was facing periodic lockdowns, the banking sector, designated as an essential service, continued to service our customers. DFCC responded to this “New normal” by shifting most staff to the online mode, providing them with secure VPN access to the Bank’s network, as well as the necessary equipment and infrastructure to work seamlessly from their homes.

Roster systems and split work arrangements were implemented, that helped the Bank maintain a reduced staff presence, in line with social-distancing regulations. Regular communications with staff kept them informed of protocols deployed, safety in the workplace, and best practices to be followed at home while all mandated safety protocols were diligently followed on Bank premises. Transport facilities were provided for staff located in main buildings of the Bank to minimise their reliance on public transport. Special safety dispensations were accorded to pregnant and vulnerable staff.

Support was provided to COVID-19 positive staff and their family members through specially set up internal support committees as well as an external engagement with Ayubo Life.

Focus on Wellness

Times such as these required our employees to be in peak mental and physical condition. Towards this end, during the year under review, special focus was accorded towards ensuring the mental and physical wellness of our employees and their families.

During the year, a special wellness initiative, “OMMM” was launched. The OMMM initiative takes a holistic perspective on wellness and the primary objective of this initiative is motivating and engaging employees towards improving their health and wellness. Towards this end the OMMM Committee organised many activities such as regular fellowship biking events, a team-based step challenge, a FIIT challenge, regular yoga classes including a year-end yoga retreat, workshops on mindfulness etc. Additionally, the Engagement Unit of the HR Department continued to drive health and wellness initiatives through an annual wellness calendar with defined areas of focus for each month, arranging virtual fitness classes, provision of subsidised gym memberships, programmes on mental wellness and stress management, etc. As a new initiative, a confidential wellness hotline and counseling service was launched for staff and their families.

Opportunities for Social Engagement

Despite the restrictions on physical and social interactions encountered during the year, every effort was made to engage staff through multiple events most of which were conducted virtually. Some of the interactive opportunities provided to staff during the year included the following:

| Ride to Work Days | February, March, April, July and December 2021 | |

| Mindfulness Programme – Physical and Virtual | February and March 2021 | |

| Yoga Class – Physical and Virtual | February 2021 onwards | |

| Women’s Day Celebrations – Virtual | March 2021 | |

| Virtual Step Challenge | March to May 2021 | |

| Virtual Town Hall meeting for all staff with CEO | May 2021 | |

| Virtual Annual Art Exhibition | May 2021 | |

| Virtual Poson Bakthi Gee | June 2021 | |

| Virtual Annual Awards Ceremony | July 2021 | |

| Virtual Zumba Classes | January 2021 onwards | |

| Youth Day Virtual Programme | August 2021 | |

| Connect Virtual Quiz | September 2021 | |

| World Children’s Day – Virtual kids Programme | October 2021 | |

| FHIIT Challenge | December 2021 | |

| Yoga Retreat Programme | December 2021 | |

| Virtual kids Christmas Party | December 2021 | |

| Christmas Carols Event | December 2021 |

The Bank Welfare and Recreation Club made arrangements to provide subsidised purchases and also provided departments and branches with financial support to organise restricted events within their own respective “bubbles”. DFCC REDS, a cross-functional team that has been active in the Bank for over a decade, continued to assist new recruits to assimilate into the culture of the Bank.

Over the years the Bank has remained committed to broader social and community development. Our geographically dispersed extensive branch network actively engages with and supports communities in their surrounding locations. The Bank has provided relief assistance and rebuilding support during times of difficulty. In 2021, to commemorate International Women’s Day, several knowledge enhancement workshops covering aspects such as tea and general cultivation, dairy farming and beauty salons were conducted targeting small scale female entrepreneurs. Additionally, the Bank continued its partnership with Caritas Sri Lanka – SEDEC to launch a scholarship programme to provide financial assistance for youth belonging to vulnerable, low-income families while educational assistance was provided to Lankadhara Transit Home for girls. Additionally, during the year, participants of the two aforementioned programmes as well as those successfully completing the “Semata English” programme have been offered internship and employment opportunities. The island-wide campaign launched during the year, “Digital Dansala” focused on providing emergency relief to people impacted through lockdowns while hand washing booths and safety equipment were also distributed to schools to support the recommencement of schools subsequent to prolonged COVID-19 related closures.

Additionally, the Bank continued to actively support staff welfare by providing extended paid leave and financial assistance in the event of serious medical emergencies.

Ensuring an Inclusive, Equitable and Supportive Work Culture

DFCC has consistently advocated and promoted a diverse and inclusive environment. DFCC is an equal opportunity employer, and as such, Bank policies and processes are transparent, accessible and equitably administered across all relevant stakeholders. In terms of recruitment, transfers, promotions and talent development, decisions are made with the primary objective of selecting most deserving and competent candidates, irrespective of socio-economic status, ethnic, religious, disability or gender considerations. This equability extends to pay parity as very aptly demonstrated by the table below:

| Grade | Basic salary ratio (Male:Female) | |

| Management | 49:51 | |

| Executive | 50:50 | |

| Supervisory staff | 46:54 | |

| Junior staff | 49:51 | |

| Total | 49:51 |

In keeping with the Bank’s stand on inclusivity, differently-abled persons are considered in the provision of permanent and contractual employment opportunities based on their abilities and competencies.

During the year, much focus was extended towards furthering gender parity, in accordance with the Bank’s 2025 sustainability goals. Multiple workshops on female empowerment were held to encourage our female employees and spur them to take on managerial and higher-level roles. The first targeted leadership development programme was conducted for 28 selected mid-level female employees utilising internal and external resource persons. In another first, two gender sensitisation programmes were conducted targeting about 300 managers and senior executives. The programmes which focused on aspects such as inclusivity and gender sensitivity, unconscious bias, appropriate behaviours etc. were very interactive and participatory, and received a lot of positive feedback from staff. The Reach Out Committee, which focuses on the personal and professional needs of our female staff, continued to be active and enhanced their presence regionally. To further cement our commitment, commencing from 2022, the Bank formally adopted “Diversity, Equity and Inclusion” as an additional core value. Going forward, our Bank policies and programmes will be further reviewed and revised to ensure that they align with and support our values. In recognition of our commitment to gender equality, DFCC Bank was recognized as one of Sri Lanka’s Top 10 Women Friendly Workplaces in 2021. The Bank is also a participant in the “Together We Can” initiative driven by International Finance Corporation, Australia Aid and Federation of Chambers of Commerce and Industry in Sri Lanka (FCCISL) and has committed to demonstrate improved gender representation across different grades/roles.

GENDER FOCUS

| Male | Female | |||

| Workforce representation | 58 | 42 | ||

| Leadership representation | 71 | 29 | ||

| Training and development participation | 56 | 44 | ||

| Career advancement | 53 | 47 | ||

| Remuneration (Ratio) | 49 | 51 | ||

| Recognised as one of Sri Lanka’s Top 10 Workplaces | ||||

| Participating in “Together We Can” initiative by IFC, Australian Aid and FCCISL | ||||

Special programmes held in 2021

|

||||

External programmes

|

||||

Collective Bargaining

DFCC Bank takes an enlightened view of the concerns and grievances of employees, who have the opportunity to utilise multiple avenues of communication to present their viewpoints, concerns and other issues to Senior Management of the Bank. The grievance escalation methodology and workflow has played a successful role in creating sense of contentment, and empowering employees. The open-door policy, which has been a staple at the Bank for a long time, allows employees to raise their concerns directly with any member of the Senior Management, including the CEO and Chairman. The open nature of communication between the Bank’s Senior Management and employees addresses issues as and when they arise and creates a sense of camaraderie. As a result, a strong-enough reason to establish any collective bargaining agreements has not arisen among our employees.

Benefits

Emoluments and other benefits provided to staff are reviewed from time to time and revised in line with industry practices and internal policies. The following table lists out the benefits provided to full-time employees of the Bank. These benefits are not extended to contract, temporary or part-time employees.

| Employment type | Housing loan | Vehicle loan* | Exam* | Professional subscription* | Social Club gymnasium* | Miscellaneous/ Staff loan | Festival advance** | MBA loan | Holiday grant*** | |

| Permanent | √ | √ | √ | √ | √ | √ | √ | √ | √ | |

| Contract | x | x | x | x | x | x | x | x | x |

* Also provided to Executive Trainees and Management Trainees on fixed term contracts.

** Only for junior staff.

*** Based on the offer of employment, may also be provided to contract staff.